Holiday Inn 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FIGURE 16

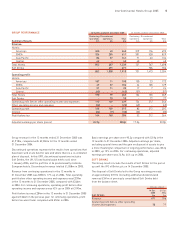

31 Dec 31 Dec

Interest risk profile of gross debt for 2005 2004

major currencies (including currency swaps) %%

At fixed rates 36 27

At variable rates 64 73

Credit risk on treasury transactions is minimised by operating

a policy on the investment of surplus funds that generally restricts

counterparties to those with an A credit rating or better, or

those providing adequate security. Limits are set for individual

counterparties. Most of the surplus funds are held in the UK or US

and there are no material funds where repatriation is restricted as

a result of foreign exchange regulations.

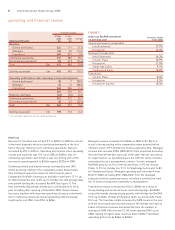

ACCOUNTING POLICIES

The audited financial statements for the year ending 31 December

2005 are produced for the first time in line with IFRS. This has

required the preparation of an opening balance sheet at 1 January

2004 to be prepared under IFRS, and a full income statement,

balance sheet and cash flow statement for the year ending

31 December 2004 for comparative purposes.

Further details on accounting policy changes can be found in

Corporate Information and Accounting Policies on page 38.

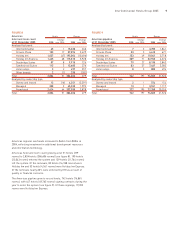

PENSIONS

As at 31 December 2005, the Group operated two main pension

schemes, the InterContinental Hotels UK Pension Plan and the

US-based InterContinental Hotels Pension Plan.

At 31 December 2005, the InterContinental Hotels UK Pension Plan

had a deficit of £24m. The defined benefits section of this Plan is

generally closed to new members.

The US-based InterContinental Hotels Pension Plan is closed to

new members and pensionable service no longer accrues for current

employee members. At 31 December 2005, the Plan had a deficit

of £41m.

EMPLOYEES

IHG employed an average of 21,986 people worldwide in the year

ended 31 December 2005.

The hospitality industry is a people-based business and IHG places

great emphasis on:

• developing leaders;

• engaging and motivating its employees;

• rewarding and recognising achievement;

• pensions;

• health and safety;

• learning; and

• flexibility and diversity.

A more comprehensive discussion of the Group’s employee focus

can be found in the Annual Review and Summary Financial

Statement 2005.

CORPORATE SOCIAL RESPONSIBILITY

The Group is committed to building a stronger culture of Corporate

Social Responsibility (CSR) and to meeting its global obligations as

one of the world’s leading international hotel businesses. During

2005, the Board considered an analysis of the CSR opportunities

and risks facing the business and its reputation, and reaffirmed its

resolve to increase the Group’s commitment to CSR during 2006.

Further details can be found in the Annual Review and Summary

Financial Statement 2005, and on the Company’s website.

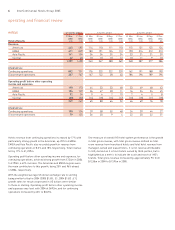

operating and financial review

14 InterContinental Hotels Group 2005