Holiday Inn 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

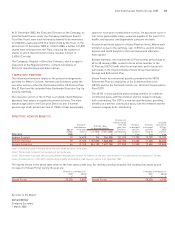

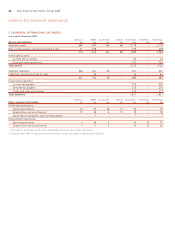

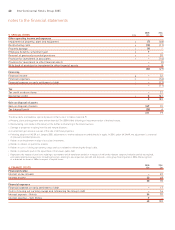

1 EXCHANGE RATES

The results of foreign operations have been translated into

sterling at weighted average rates of exchange for the period.

In the case of the US dollar, the translation rate is £1=$1.83

(2004 £1=$1.82). In the case of the euro, the translation rate is

£1=€1.46 (2004 £1=€1.47).

Foreign currency denominated assets and liabilities have been

translated into sterling at the rates of exchange on the balance

sheet date. In the case of the US dollar, the translation rate is

£1=$1.73 (2004 £1=$1.93). In the case of the euro, the translation

rate is £1=€1.46 (2004 £1=€1.41).

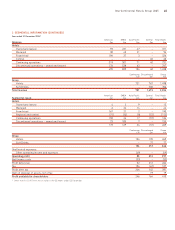

2 SEGMENTAL INFORMATION

Hotels

The primary segmental reporting format is determined to be three

main geographical regions:

the Americas;

Europe, the Middle East and Africa (EMEA); and

Asia Pacific.

These, together with Central functions, form the principal format by

which management is organised and makes operational decisions.

The Group further breaks each geographic region into three

distinct business models which offer different growth, return, risk

and reward opportunities:

Franchised Where Group companies neither own nor manage the

hotel, but license the use of a Group brand and provide access to

reservation systems, loyalty schemes, and know-how. The Group

derives revenues from a brand royalty or licensing fee, based on

a percentage of room revenue.

Managed Where, in addition to licensing the use of a Group brand,

a Group company manages the hotel for third party owners.

The Group derives revenues from base and incentive management

fees and provides the system infrastructure necessary for the hotel

to operate. Management contract fees are generally a percentage

of hotel revenue and may have an additional incentive fee linked

to profitability or cash flow. The terms of these agreements

vary, but are often long-term (for example, 10 years or more).

The Group’s responsibilities under the management agreement

typically include hiring, training and supervising the managers

and employees that operate the hotels under the relevant brand

standards. In order to gain access to central reservation systems,

global and regional brand marketing and brand standards and

procedures, owners are typically required to make a further

contribution.

Owned and leased Where a Group company both owns (or leases)

and operates the hotel and, in the case of ownership, takes all the

benefits and risks associated with ownership. The Group has sold,

or plans to sell, the majority of its owned and leased portfolio and

in future expects to only own hotels where it is considered

strategically important to do so.

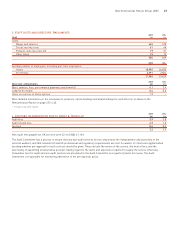

Segmental results, assets and liabilities include items directly

attributable to a segment as well as those that can be allocated

on a reasonable basis.

Soft Drinks

Manufactures a variety of soft drink brands with distribution

concentrated mainly in the UK.

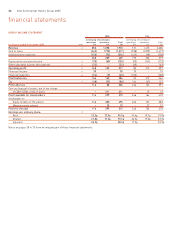

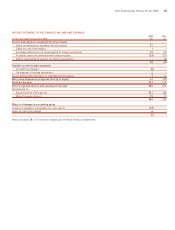

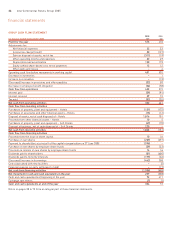

notes to the financial statements

42 InterContinental Hotels Group 2005