Holiday Inn 2005 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Return of Funds

IHG’s second £250m on-market share repurchase programme was

announced in September 2004 and commenced in December 2004.

In 2005, 30.6 million shares were repurchased at an average price

of 672p making the total purchased under the second programme

£211m. On 8 September 2005, IHG announced a further £250m

share repurchase programme to commence on completion of the

second programme. The precise timing of share purchases will be

dependent on, amongst other things, market conditions. Purchases

are under the existing authority from shareholders which will be

renewed at the Annual General Meeting. Any shares repurchased

under this programme will be cancelled.

On 8 July 2005, IHG returned a further £996m capital to

shareholders following the capital reorganisation of the Group

completed in June 2005. Under the reorganisation, shareholders

received 11 new ordinary shares and £24.75 cash in exchange

for every 15 existing ordinary shares held on 24 June 2005.

A more detailed explanation of the capital reorganisation is

contained in the Directors’ Report on page 18.

In March 2006, IHG announced that a £500m special dividend

will be paid to shareholders in the second quarter of 2006.

Since April 2003, IHG has announced the return of £2.75bn

of funds to shareholders by way of special dividends, share

repurchase programmes and capital returned (see figure 4).

Management and Organisation

During 2005, a number of key organisational changes were made

to support the achievement of IHG’s strategic priorities, including:

• the appointment of Stevan Porter as Global Leader, Franchise

Strategy with responsibility for the development and deployment

of best practice in franchising globally in addition to his role as

President, The Americas;

• the appointment of Peter Gowers as Chief Marketing Officer,

with responsibility for the development of IHG’s worldwide brand

priorities and brand management;

• expanding the role of Richard Solomons, Finance Director to

include the development of relationships with major investors

operating in multiple countries;

• the realignment of certain functions (Finance, Human Resources

and Information Technology) under global functional heads to

gain synergies and increase the focus of the organisation on

achieving the strategic priorities; and

• the appointment of Tracy Robbins as Executive Vice President,

Human Resources.

On 31 January 2006, the Group announced the appointment of Tom

Conophy as Chief Information Officer.

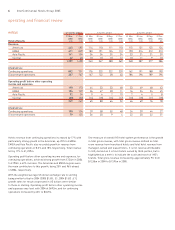

operating and financial review

4InterContinental Hotels Group 2005

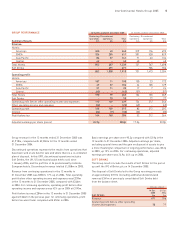

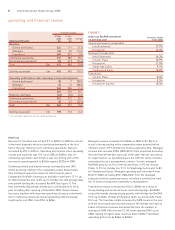

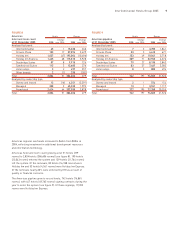

FIGURE 3

Asset disposal programme detail Number of hotels Proceeds Net book value

Disposed to date 144 £2.3bn £2.2bn

On the market 31 – £0.6bn

Remaining hotels 22 – £0.9bn

FIGURE 4

Return of funds programme Timing Total return Returned to date Still to be returned

£501m special dividend Paid December 2004 £501m £501m Nil

First £250m share buyback Completed in 2004 £250m £250m Nil

Second £250m share buyback Ongoing £250m £211m £39m

£996m capital return Paid 8 July 2005 £996m £996m Nil

Third £250m share buyback Yet to commence £250m – £250m

£500m special dividend Second quarter 2006 £500m – £500m

Total £2,747m £1,958m £789m