Holiday Inn 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

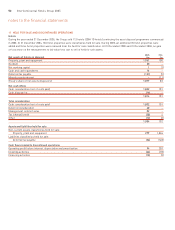

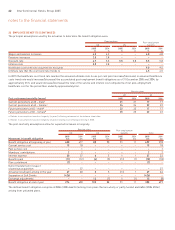

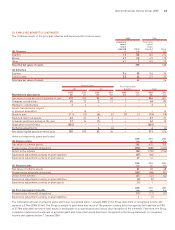

23 EMPLOYEE BENEFITS (CONTINUED)

The principal assumptions used by the actuaries to determine the benefit obligation were:

Pension plans Post-employment

UK US benefits

2005 2004 2005 2004 2005 2004

%%%%%%

Wages and salaries increases 4.3 4.3 ––4.0 4.0

Pensions increases 2.8 2.8 ––––

Discount rate 4.7 5.3 5.5 5.8 5.5 5.8

Inflation rate 2.8 2.8 ––––

Healthcare cost trend rate assumed for next year 9.0 9.5

Ultimate rate that the cost trend rate trends to 4.5 4.5

In 2015 the healthcare cost trend rate reaches the assumed ultimate rate. A one per cent point increase/(decrease) in assumed healthcare

costs trend rate would increase/(decrease) the accumulated post-employment benefit obligations as of 31 December 2005 and 2004, by

approximately £1m, and would increase/(decrease) the total of the service and interest cost components of net post-employment

healthcare cost for the period then ended by approximately £nil.

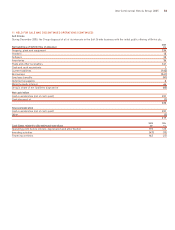

Pension plans

UK US

Post-retirement mortality (years) 2005 2004 2005 2004

Current pensioners at 65 – malea21 21 17 17

Current pensioners at 65 – femalea24 24 22 22

Future pensioners at 65 – maleb22 22 17 17

Future pensioners at 65 – femaleb25 25 22 22

a Relates to assumptions based on longevity (in years) following retirement at the balance sheet date.

b Relates to assumptions based on longevity (in years) relating to an employee retiring in 2020.

The post-mortality assumptions allow for expected increases in longevity.

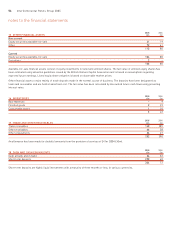

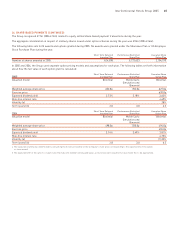

Pension plans Post-employment

UK US benefits Total

2005 2004 2005 2004 2005 2004 2005 2004

Movement in benefit obligation £m £m £m £m £m £m £m £m

Benefit obligation at beginning of year 600 477 88 90 11 11 699 578

Current service cost 19 18 ––––19 18

Past service cost –1–––––1

Members’ contributions 22––––22

Interest expense 30 27 651137 33

Benefits paid (11) (12) (6) (5) (1) (1) (18) (18)

Plan curtailment (7) –––––(7) –

Deficit transferred in respect

of previous acquisition –27 –––––27

Actuarial loss/(gain) arising in the year 67 60 35(1) 169 66

Separation of Soft Drinks (426) –––––(426) –

Exchange adjustments ––12 (7) 1(1) 13 (8)

Benefit obligation at end of year 274 600 103 88 11 11 388 699

The defined benefit obligation comprises £328m (2004 £647m) arising from plans that are wholly or partly funded and £60m (2004 £52m)

arising from unfunded plans.

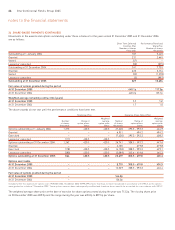

notes to the financial statements

62 InterContinental Hotels Group 2005