Holiday Inn 2005 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

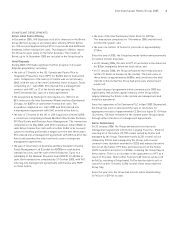

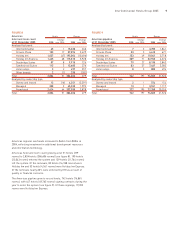

12 months ended

31 Dec 31 Dec

2005 2004 Change

Central Results £m £m %

Revenue 42 40 5.0

Gross central costs (107) (97) 10.3

Net central costs £m (65) (57) 14.0

Dollar equivalent $m (118) (102) 15.7

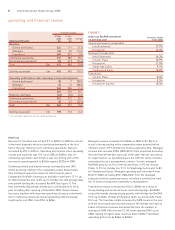

CENTRAL

Net central overheads increased by £8m reflecting increased

governance costs, further investment to support development

and the accounting treatment of share scheme costs. Under IFRS,

the charges for share option schemes established after November

2002 are accounted for in the income statement. As share scheme

awards are generally made annually and the accounting cost is

spread over three years, 2005 is the first year that a full annual cost

is taken into account. Total Hotels’ overheads were flat year-on-year

after adjusting for inflation.

OTHER OPERATING INCOME AND EXPENSES

Other operating income and expenses totalled a net expense

of £22m in 2005 compared with a net expense of £49m in 2004.

The £22m net expense in 2005 included:

• £13m costs relating to the further restructuring of the

Hotels business;

• £9m costs of property damage relating to fire and natural

disasters;

• £7m charge for impairment of property; and

• £7m credit for employee benefits curtailment as a result of the

UK hotels disposal.

Other operating income and expenses are by their size and nature

considered to be exceptional and are shown as special items and

excluded from the calculation of adjusted earnings per share to

give a more meaningful comparison of performance.

NET FINANCING COSTS

Net financing costs totalled £33m in 2005, the same as in 2004. In

2005, £9m related to Soft Drinks and is classified as discontinued

operations. The prior year net financing expense included a net

£11m charge that is treated as a special item and is excluded from

the calculation of adjusted earnings per share.

TAXATION

The effective rate of tax on profit before tax, excluding the impact

of special items, was 28.6%. By also excluding the impact of prior

year items, which are included wholly within continuing operations,

the equivalent effective tax rate would be 37.8%. This rate is higher

than the UK statutory rate of 30% due mainly to overseas profits

being taxed at rates higher than the UK statutory rate. The

equivalent effective rates for 2004, restated under IFRS, were

17.3% and 38.6% respectively.

Taxation special items totalled an £8m credit (2004 £183m credit).

In 2005, this represented the release of provisions which were

special by reason of their size or incidence, relating to tax matters

which were settled during the year, or in respect of which the

statutory limitation period had expired. In 2004, taxation special

items, in addition to such provision releases, included £83m for the

recognition of a deferred tax asset in respect of capital losses.

Net tax paid in 2005 was £91m (2004 £35m) including £11m in

respect of disposals.

GAIN ON DISPOSAL OF ASSETS

The gain on disposal of assets, net of related tax, totalled £311m

in 2005 and mainly comprised a net gain on disposal of Soft Drinks

of £284m and a net gain on hotel asset disposals of £27m.

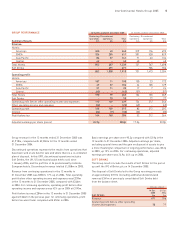

EARNINGS

Basic earnings per share for 2005 were 95.2p, compared with 53.9p

in 2004. Adjusted earnings per share, removing the non-comparable

special items and gain on disposal of assets, were 38.2p, against

33.9p in 2004. Adjusted earnings per share for continuing

operations were 24.9p, 44% up on last year.

DIVIDENDS

The Board has proposed a final dividend per share of 10.70p;

with the interim dividend of 4.60p the normal dividend for 2005

totalled 15.30p.

SHARE PRICE AND MARKET CAPITALISATION

The InterContinental Hotels Group PLC share price closed at

839.50p on 31 December 2005, up from 647.50p on 31 December

2004. The market capitalisation of the Group at the year end was

£3.6bn.

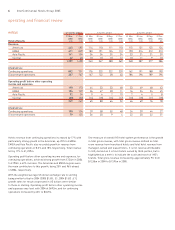

CAPITAL EXPENDITURE AND CASH FLOW

The net movement in cash and cash equivalents in the 12 months

to 31 December 2005 was an inflow of £259m. This included a cash

inflow from operations of £423m, and a net cash inflow from

investing activities of £1,863m.

Proceeds from the disposal of operations and other financial

assets totalled £2,046m and included proceeds from the sale of

Soft Drinks £220m and hotels £1,826m.

Capital expenditure for Hotels totalled £136m, lower than 2004

as the Group continued its asset disposal programme. Capital

expenditure in 2005 for Hotels included the InterContinental

London and Holiday Inn Munich City Centre refurbishments and

a rolling rooms refurbishment programme at the InterContinental

Hong Kong.

operating and financial review

12 InterContinental Hotels Group 2005