Holiday Inn 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

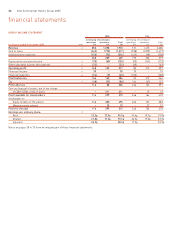

Individual performance is measured through an assessment of

comprehensive business unit deliverables, demonstrated leadership

behaviours, modelling the Group values and the achievement of

specific Key Performance Objectives. At the executive level, Key

Performance Objectives are linked directly to the Group’s strategic

priorities. At a minimum, the individual performance of the

Executive Directors is assessed on an annual basis.

The normal policy for Executive Directors is that, using ‘target’ or

‘expected value’ calculations, their performance-related incentives

will equate to approximately 70% of total annual remuneration

(excluding benefits).

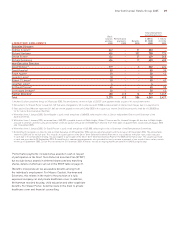

The main components of remuneration are:

Basic salary The salary for each Executive Director is based on

individual performance and on information from independent

professional sources on the salary levels for similar jobs in groups

of comparable companies. Internal relativities and salary levels in

the wider employment market are also taken into account.

In addition, benefits are provided to Executive Directors in

accordance with the policy applying to other executives in their

geographic location.

Annual performance bonus Within both the Short Term Incentive

Plan and the Short Term Deferred Incentive Plan, challenging

performance goals are set and these must be achieved before

the maximum bonus becomes payable. The Short Term Incentive

Plan is linked to personal objectives and the Short Term Deferred

Incentive Plan is linked to the Group’s financial performance.

For Executive Directors, the maximum bonus opportunity under the

Short Term Incentive Plan in 2006 is 80% of salary and is payable

in cash. The maximum bonus opportunity under the Short Term

Deferred Incentive Plan in 2006 is 100% of salary, with 50% linked

to adjusted earnings per share and 50% to earnings before special

items, interest and taxation. The performance level required to

trigger maximum bonus is 110% of budget for both measures.

This bonus will normally be paid in IHG PLC shares and deferred.

Matching shares may also be awarded up to 0.5 times the

deferred amount. Such awards are conditional on the Directors’

continued employment with the Group until the release date.

The shares will normally be released at the end of the three years

following deferral.

The Executive Directors will be expected to hold all shares earned

from the Group’s remuneration plans while the value of their

holding is less than twice their basic salary or three times in the

case of the Chief Executive.

Bonuses are not pensionable.

Executive share options Following a full review of incentive

arrangements, the Committee has concluded that share options

are not the most effective incentive for the foreseeable future and

therefore no further grants of options will be made. However, the

Committee believes that share ownership by Executive Directors

and senior executives strengthens the link between the individual’s

personal interest and that of the shareholders.

For options granted in 2005, the Company’s adjusted earnings per

share over the three-year period ending 31 December 2007 must

increase by at least nine percentage points over the increase in the

UK Retail Prices Index (RPI) for the same period for one-third of the

options granted to vest; 12 percentage points over the increase in RPI

for the same period for two-thirds of the options granted to vest; and

15 percentage points over the increase in RPI for the same period for

the full award to vest. The options lapse if the performance condition

is not met. This remains a realistic but challenging condition in the

current economic climate. The achievement or otherwise of the

performance condition is assessed, based on the Group’s published

results; such assessment is then reviewed by the external auditor.

Executive Directors were granted options on 4 April 2005 as shown

in the table on page 32.

Executive share options are not pensionable.

Executive Directors are entitled to participate in all-employee share

plans. Options granted under the IHG Sharesave Plan are not

subject to performance conditions and are not pensionable.

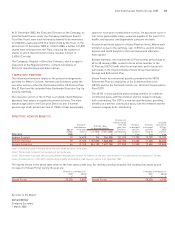

Performance restricted shares The Performance Restricted

Share Plan allows Executive Directors and eligible employees to

receive share awards, subject to the satisfaction of a performance

condition, set by the Committee, which is normally measured

over a three-year period. Awards are normally made annually and,

except in exceptional circumstances, will not exceed three times

annual salary for Executive Directors. In determining the level

of awards within this maximum limit, the Committee takes into

account the level of executive share options granted to the same

person. The grant of awards is restricted so that in each year the

aggregate of (i) 20% of the market value of the executive share

options and (ii) 33% of the market value of performance restricted

shares, will not exceed 130% of annual salary, taking the market

value in each case as at the date of grant.

For the 2005/07 cycle, performance will be measured by

reference to:

• the increase in IHG PLC Total Shareholder Return (TSR) over

the performance period relative to 10 identified comparator

companies: Accor, De Vere, Hilton Group, Hilton Hotels Corp.,

Host Marriott, Marriott Hotels, Millennium & Copthorne,

NH Hotels, Sol Melia and Starwood Hotels; and

• the cumulative annual growth (CAGR) in the number of rooms

within the IHG system over the performance period relative

to nine identified comparator companies:

Carlson Hospitality Worldwide, Cendant, Choice,

Hilton Group, Hilton Hotels Corp., Hyatt Hotels & Resorts,

Marriott Hotels, Sol Melia and Starwood Hotels.

In respect of TSR performance, 10% of the award will be released for

the achievement of sixth place within the TSR group and 50% of the

award will be released for the achievement of first or second place.

In respect of rooms CAGR performance, 10% of the award will be

released for the achievement of median growth and 50% of the

award will be released for the achievement of upper quartile growth.

Vesting between all stated points will be on a straight line basis.

remuneration report

26 InterContinental Hotels Group 2005