Holiday Inn 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

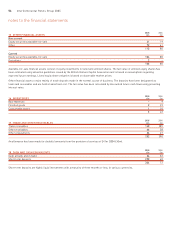

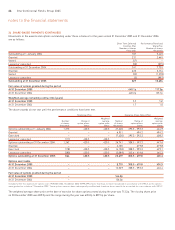

24 SHARE-BASED PAYMENTS (CONTINUED)

Movements in the awards and options outstanding under these schemes for the years ended 31 December 2005 and 31 December 2004

are as follows:

Short Term Deferred Performance Restricted

Incentive Plan Share Plan

Number of shares Number of shares

thousands thousands

Outstanding at 1 January 2004 107 5,445

Granted 231 2,665

Vested (47) –

Lapsed or cancelled (50) (375)

Outstanding at 31 December 2004 241 7,735

Granted 625 5,174

Vested (32) (1,278)

Lapsed or cancelled (5) (997)

Outstanding at 31 December 2005 829 10,634

Fair value of options granted during the period

At 31 December 2005 649.1p 117.0p

At 31 December 2004 448.3p 125.1p

Weighted average remaining contract life (years)

At 31 December 2005 1.1 1.2

At 31 December 2004 1.7 1.0

The above awards do not vest until the performance conditions have been met.

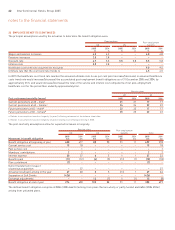

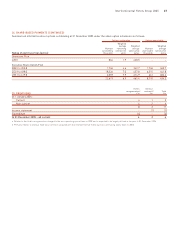

Sharesave Plan Executive Share Option Plan

Weighted Weighted

Number Range of average Number Range of average

of shares option prices option price of shares option prices option price

thousands pence pence thousands pence pence

Options outstanding at 1 January 2004 1,373 420.5 420.5 27,220 295.3 - 593.3 424.9

Granted – – – 6,951 494.2 494.2

Exercised – – – (7,430) 295.3 - 593.3 408.2

Lapsed or cancelled (111) 420.5 420.5 – – –

Options outstanding at 31 December 2004 1,262 420.5 420.5 26,741 308.5 - 593.3 447.6

Granted – – – 2,105 619.8 619.8

Exercised (118) 420.5 420.5 (4,138) 308.5 - 593.3 429.1

Lapsed or cancelled (280) 420.5 420.5 (2,089) 345.6 - 619.8 465.3

Options outstanding at 31 December 2005 864 420.5 420.5 22,619 308.5 - 619.8 465.4

Options exercisable

At 31 December 2005 – – – 8,710 308.5 - 619.8 434.3

At 31 December 2004 – – – 12,569 308.5 - 593.3 426.4

Fair value of options granted during the period

At 31 December 2005 – 164.0p

At 31 December 2004 – 136.0p

Included within this balance are options over 7,909,002 (2004 12,568,562; 2003 19,998,299) shares that have not been recognised in accordance with IFRS 2 as the options

were granted on or before 7 November 2002. These options have not been subsequently modified and therefore do not need to be accounted for in accordance with IFRS 2.

The weighted average share price at the date of exercise for share options vested during the year was 713.3p. The closing share price

on 30 December 2005 was 839.5p and the range during the year was 635.0p to 839.5p per share.

notes to the financial statements

66 InterContinental Hotels Group 2005