Holiday Inn 2005 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

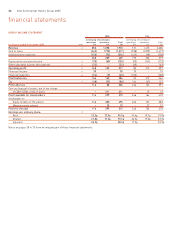

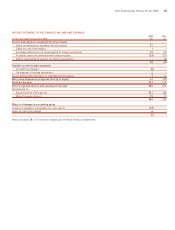

As indicated in last year’s Remuneration Report, the asset disposal

programme, which can significantly impact Return on Capital

Employed (ROCE), will be complete during 2006. The Committee

believes that a rooms’ growth related performance measure is now

the more appropriate measure going forward, effectively aligning

an appropriate element of incentive pay with the Group’s stated

objective of increasing the number of rooms in the IHG system.

Benefits under the Performance Restricted Share Plan are not

pensionable and the awards lapse if the performance conditions

are not met.

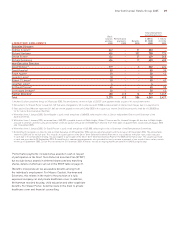

During the year, IHG has remained within its headroom limits for

the issue of new shares under share incentive schemes. Prior to

the capital reorganisation of June 2005 and the consequent

reduction in the Company’s share capital, the Company’s position

under the Association of British Insurers’ guidelines (that dilution

under discretionary schemes should not exceed 5% in 10 years)

was that shares equivalent to only 4.58% of ordinary share capital

had been allocated. Against the guideline that overall dilution

under all schemes should not exceed 10% in 10 years, IHG had

allocated only 4.95%. These figures exclude obligations which

are to be settled with shares purchased in the market.

3.3 Companies used for comparison

In assessing levels of pay and benefits, IHG compares the packages

offered by different groups of comparator companies.

These groups are chosen having regard to participants’:

• size – turnover, profits and the number of people employed;

• diversity and complexity of businesses;

• geographical spread of businesses;

• industry type; and

• relevance as:

a) a potential recruitment target

b) a potential threat in respect of attracting IHG talent.

External consultants are used to advise the Committee on the

structure and level of pay and benefits in IHG’s markets.

3.4 Policy on external appointments

The Company recognises that its Directors may be invited to

become Non-Executive Directors of other companies and that

such duties can broaden experience and knowledge, and benefit

the business. Executive Directors are, therefore, allowed to accept

one Non-Executive appointment (excluding positions where the

Director is appointed as the Group’s representative), subject to

Board approval, as long as this is not likely to lead to a conflict of

interest, and to retain the fees received. David Webster received

£20,000 during the year for his services as a Non-Executive

Director.

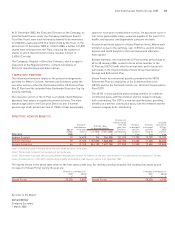

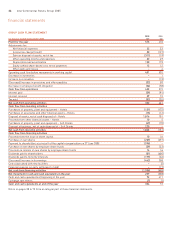

3.5 Performance graph

Throughout the year, the Company has been a member of the

FTSE 100 index. The graph below measures the performance of

Six Continents PLC up to Separation, and subsequently the

performance of IHG PLC, assuming dividends are reinvested,

compared with the TSR performance achieved by the FTSE 100

companies.

InterContinental Hotels Group 2005 27

250

200

150

100

50

0

Source: Datastream

IHG PLC shares listed 15.4.03

InterContinental Hotels Group PLC – Total Shareholder Return Index

(Six Continents PLC up to 14 April 2003)

FTSE 100 – Total Shareholder Return Index

Total Shareholder Return: InterContinental Hotels Group v FTSE 100

Oct 2000 Oct 2001 Oct 2002 Jan 2004 Jan 2005 Jan 2006

(Mean average index for the month – October 2000=100)