Holiday Inn 2005 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

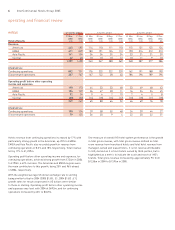

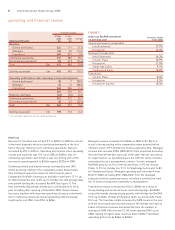

Europe, Middle East and Africa (EMEA)

The EMEA operating model changed in 2005 as a result of the

disposal of 73 hotels in the UK to LRG and a number of smaller

transactions. As a result, the number of owned and leased hotels

reduced by 85 whilst the number of managed hotels increased by

77, including 73 with LRG.

Revenue from continuing operations increased by 8.3% to £326m

and continuing operating profit before other operating income and

expenses increased by 96% to £47m.

Owned and leased revenue from continuing operations increased

by 2.2% from £231m in 2004 to £236m. Performance across the

region was mixed, with variable trading conditions in parts of

Continental Europe. The refurbishment of the InterContinental

London impacted the overall result, with the hotel being disrupted

for most of the year and closed in the final quarter of the year.

Owned and leased operating profit from continuing operations

increased by £9m to £11m.

Managed revenue increased by £12m to £55m. The 2004 result

benefited from the receipt of approximately £4m liquidated

damages from the early termination of the InterContinental

Barcelona management contract. The 2005 result was affected by

a loss of earnings following the bombings in Beirut, but underlying

trading was strong, particularly in the Middle East where managed

RevPAR increased by 11.9%. Management fees are also included

from LRG for the hotels sold in May 2005 (including incentive fees);

Holiday Inn UK RevPAR overall was up by 4.6% (see figure 10).

Franchised revenue for EMEA increased by £8m to £35m. Holiday

Inn franchise RevPAR increased by 4.9% and Holiday Inn Express

RevPAR increased by 5.9%. Franchised operating profit increased

by £5m to £26m and included £7m liquidated damages for the

termination of franchise agreements in South Africa.

EMEA hotel and room count was broadly level with 31 December

2004 at 610 hotels (105,419 rooms) despite the termination of the

master franchise agreement in South Africa (6,338 rooms) (see

figure 11). Two significant deals added hotels to the system during

the year; five Holiday Inn hotels (602 rooms), in the UK from a

franchise agreement with Stardon, a joint venture company formed

between Starwood Capital Europe and Chardon Hotels, and 13

hotels (2,233 rooms) in the UK from a franchise agreement with

Queens Moat Houses Limited.

The EMEA pipeline at 31 December 2005 was 86 hotels

(14,278 rooms).

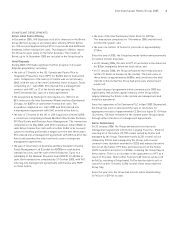

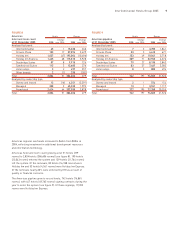

12 months ended

31 Dec 31 Dec

2005 2004 Change

EMEA Results £m £m %

Revenue:

Owned and leased 236 231 2.2

Managed 55 43 27.9

Franchised 35 27 29.6

Continuing operations 326 301 8.3

Discontinued operations* 285 528 (46.0)

Total £m 611 829 (26.3)

Dollar equivalent $m 1,115 1,511 (26.2)

Operating profit before other operating income and expenses:

Owned and leased 11 2 450.0

Managed 31 24 29.2

Franchised 26 21 23.8

68 47 44.7

Regional overheads (21) (23) (8.7)

Continuing operations 47 24 95.8

Discontinued operations* 57 105 (45.7)

Total £m 104 129 (19.4)

Dollar equivalent $m 189 235 (19.6)

* Discontinued operations are all owned and leased.

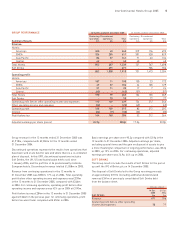

FIGURE 10

EMEA RevPAR movement 12 months ended

on previous year 31 Dec 2005

Owned and leased (comparable):

InterContinental 13.3%

Holiday Inn (5.3)%

Holiday Inn UK 4.6%

France 5.6%

Germany (0.3)%

Middle East 18.7%

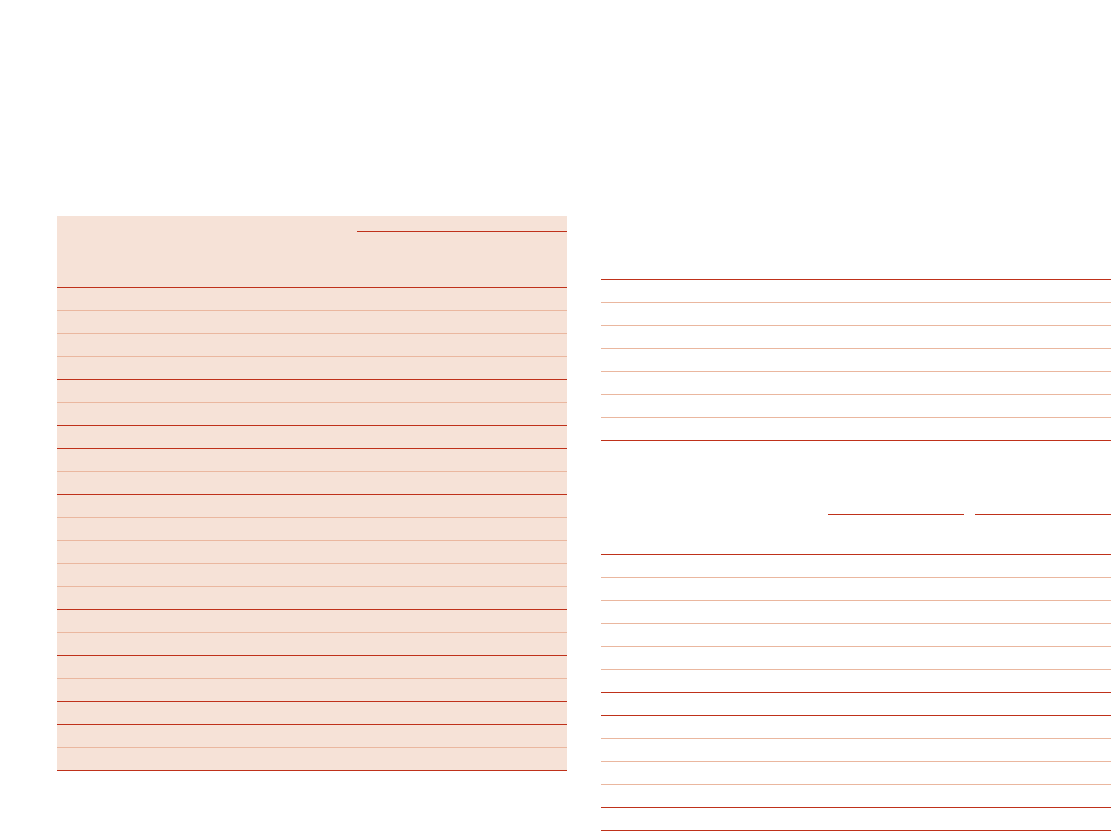

FIGURE 11

Hotels Rooms

EMEA hotel and room count Change Change

at 31 December 2005 2005 over 2004 2005 over 2004

Analysed by brand:

InterContinental 65 321,473 1,181

Crowne Plaza 64 116,031 284

Holiday Inn 320 (9) 50,944 (2,624)

Holiday Inn Express 161 816,971 1,050

Other brands –(1) –(222)

Total 610 2105,419 (331)

Analysed by ownership type:

Owned and leased 41 (85) 10,541 (15,029)

Managed 176 77 39,697 14,776

Franchised 393 10 55,181 (78)

Total 610 2105,419 (331)

operating and financial review

10 InterContinental Hotels Group 2005