Holiday Inn 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TREASURY MANAGEMENT

Treasury policy is to manage financial risks that arise in relation to

underlying business needs. The activities of the treasury function

are carried out in accordance with Board approved policies and are

subject to regular audit. The treasury function does not operate as

a profit centre.

Treasury seeks to reduce the financial risk of the Group and

ensures that there is sufficient liquidity to meet all foreseeable

cash needs. One of the primary objectives of the treasury risk

management policy is to mitigate the adverse impact of

movements in interest rates and foreign exchange rates.

Movements in foreign exchange rates, particularly the US dollar

and euro, can affect the Group’s reported profit, net assets and

interest cover. To hedge this translation exposure as far as is

reasonably practical, borrowings are taken out in foreign currencies

(either directly or via currency swaps), which broadly match those

in which the Group’s major net assets are denominated. A general

weakening of the US dollar (specifically a one cent rise in the

sterling:US dollar rate) would have reduced the Group’s profit

before tax by an estimated £1m.

Foreign exchange transaction exposure is managed by the forward

purchase or sale of foreign currencies or the use of currency

options. Most significant exposures of the Group are in currencies

that are freely convertible.

Interest rate exposure is managed within parameters that stipulate

that fixed rate borrowings should normally account for no less than

25%, and no more than 75%, of net borrowings for each major

currency. This is achieved through the use of interest rate swaps

and options and forward rate agreements.

Based on the year end net debt position, and given the

underlying maturity profile of investments, borrowings and

hedging instruments at that date, a one percentage point rise in

US dollar interest rates would increase the net interest charge

by approximately £1m whilst a one percentage point rise in

euro interest rates would increase the net interest charge

by approximately £4m.

CAPITAL STRUCTURE AND LIQUIDITY MANAGEMENT

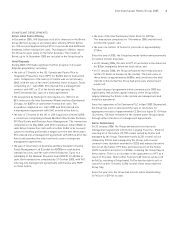

Net debt at 31 December 2005 of £88m (see figure 14) was

considerably lower than the average debt in the year (£700m) due

to the receipt of funds from hotel sales and the Britvic IPO in the

last three months of the year. The level of borrowings fluctuated

throughout 2005 with the timing of receipts of disposal proceeds

and returns to shareholders. Gearing (net debt expressed as a

percentage of shareholders’ equity) at 31 December 2005 was 8%.

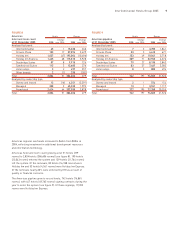

FIGURE 14

31 Dec 31 Dec

2005 2004

Net debt £m £m

Borrowings:

Sterling –247

US Dollar 220 335

Euro 488 799

Australian Dollar –86

Hong Kong Dollar 71 69

Other –2

Cash and cash equivalents (686) (422)

Less fair value of currency swaps (net) (5) –

Total 88 1,116

Note: all shown after the effect of currency swaps.

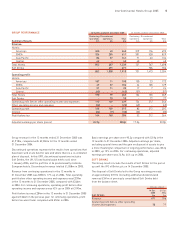

FIGURE 15

31 Dec 31 Dec

2005 2004

Facilities £m £m

Committed 1,163 1,697

Uncommitted 14 64

Total 1,177 1,761

Medium and long-term borrowing requirements at 31 December

2005 were met through a £1,100m syndicated bank facility which

matures in November 2009. Short-term borrowing requirements

were principally met from drawings under committed and

uncommitted bilateral bank facilities. At the year end, the Group

had £751m of committed facilities available for drawing.

The syndicated bank facility of the Group contains two financial

covenants, interest cover and net debt/Earnings before Interest,

Tax, Depreciation and Amortisation (EBITDA). The Group is in

compliance with both covenants neither of which is expected to

represent a material restriction on funding or investment policy

in the foreseeable future.

InterContinental Hotels Group 2005 13