Holiday Inn 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

InterContinental Hotels Group 2005 75

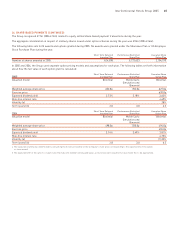

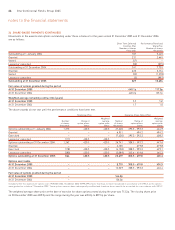

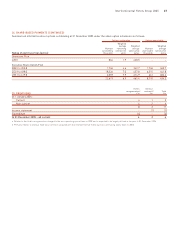

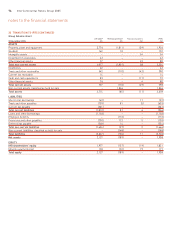

33 TRANSITION TO IFRS (CONTINUED)

Balance sheet remeasurement

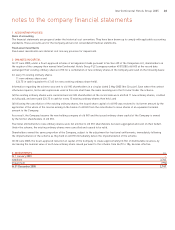

Held for sale Under IFRS, assets are classified as held for sale

when their value will be recovered through a sale transaction

rather than continuing use and management consider a sale to

be highly probable.

Assets classified as held for sale are held at the lower of their

carrying value and fair value less cost to sell. No depreciation is

charged on assets held for sale.

Goodwill Under UK GAAP, goodwill is amortised over 20 years.

Under IFRS, goodwill is subject to annual impairment testing

and is not amortised.

Employee benefit obligations Under UK GAAP, scheme assets and

liabilities are not recognised on the Group’s balance sheet. Under

IFRS, any excess or deficit of scheme assets over scheme liabilities

is recorded as an asset or liability, respectively, in the Group’s

balance sheet. Each year, the scheme net assets or liabilities are

adjusted for actuarial gains and losses which are recognised

directly in reserves.

Provisions and other payables Under IFRS, net asset carrying

values have been reduced by the remeasurement of deferred tax,

eliminating the provision for loss on disposal of operations

recognised under UK GAAP.

Deferred tax Under UK GAAP, deferred tax is provided on all timing

differences, subject to certain exceptions. Accordingly, deferred tax

is not provided on revaluation gains and gains rolled over into

replacement assets unless there exists a binding agreement for

sale, nor on unremitted earnings of investments except to the

extent of accrued dividends or where there exists a binding

agreement to distribute earnings. Under IFRS, deferred tax is

recognised on all temporary differences between the tax base and

carrying value of assets and liabilities, including those arising from

revaluation of assets, on gains rolled over into replacement assets

and on remitted earnings of investments where the Group does not

control the timing of distributions.

In addition, IFRS requires the tax base of assets and liabilities to

be determined by management’s current intended use and the

intended manner of realisation of the asset or liability.

Balance sheet reclassifications

Software Under IFRS, software is classified as an intangible asset.

Other intangible assets Under IFRS, amounts paid to hotel owners

to secure management contracts and franchise agreements are

classified as intangible assets.

Other financial assets Under IFRS, long-term receivables are

classified as non-current other financial assets.

Cash and cash equivalents Bank overdrafts repayable on demand

are a component of cash equivalents where the Group has a right

of set off.

Trade and other payables Under IFRS, dividends are recognised

as an appropriation of equity in the period in which they are

approved.

Reclassifications which do not impact net assets but which

increase non-current assets by £7m (2004 opening £11m), reduce

current assets by £18m (2004 opening £32m), current liabilities by

£6m (2004 opening increase by £16m) and non-current liabilities by

£5m (2004 opening £37m) have been made to the balance sheet at

31 December 2004 and 1 January 2004 respectively, as presented in

the 2004 Annual Report and Financial Statements. A reclassification

has also been made of £19m (2004 opening £16m), reducing IHG

shareholders’ equity and increasing minority equity interest, in

respect of dividends to minority shareholders.

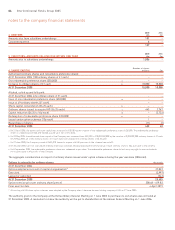

Cash flow

The transition from UK GAAP to IFRS has no effect upon reported

cash flows generated by the Group. The IFRS cash flow statement

is presented in a different format from that required under UK

GAAP with cash flows analysed into three categories of activities –

operating activities, investing activities and financing activities.

Adoption of IAS 39

The impact of adopting IAS 39 on 1 January 2005 was to reduce

other financial assets by £4m.

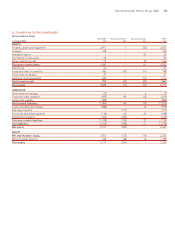

34 PRINCIPAL OPERATING SUBSIDIARY UNDERTAKINGS

InterContinental Hotels Group PLC was the beneficial owner of all

(unless specified) of the equity share capital, either itself or through

subsidiary undertakings, of the following companies during the year:

Six Continents Limited (formerly Six Continents PLC)

InterContinental Hotels Group Services Company

InterContinental Hotels Group (Management Services) Limited

InterContinental Hotels Group Operating Corporation

(incorporated and operates principally in the United States)

Soft Drinks

Britannia Soft Drinks Limited (47.5% Six Continents Investments

Limited, 23.75% Whitbread PLC, 23.75% Allied Domecq PLC, 5%

PepsiCo Holdings Limited) (note a)

Britvic Soft Drinks Limited (100% Britannia Soft Drinks Limited)

Robinsons Soft Drinks Limited (100% Britannia Soft Drinks Limited)

note a The Group exercised dominant influence and controlled Britannia

Soft Drinks Limited up to 14 December 2005 when the Group

disposed of all its interests. Accordingly, the Group’s investment

was treated as a subsidiary undertaking until the date of disposal.

note b Unless stated otherwise, companies are incorporated in Great

Britain, registered in England and Wales and operate principally

within the United Kingdom.

note c The companies listed above include all those which principally affect

the amount of profit and assets of the Group.