Holiday Inn 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

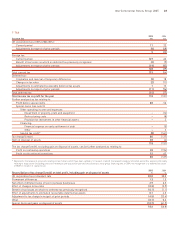

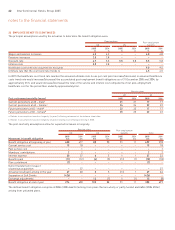

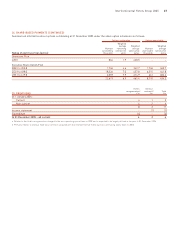

22 FINANCIAL INSTRUMENTS

Interest rate risk

For each class of interest bearing financial asset and financial liability, the following table indicates the range of interest rates effective at

the balance sheet date, the carrying amount on the balance sheet and the periods in which they reprice, if earlier than the maturity date.

Repricing analysis

Effective interest Total carrying Less than 6 months More than

rate amount 6 months -1 year 1-2 years 2 years

31 December 2005 %£m£m£m£m£m

Cash and cash equivalents 0.0 – 4.5 (324) (324) – – –

Secured bank loans (fixed)* 6.5 – 7.8 28 – – 28 –

Secured bank loans (floating) 2.9 – 8.5 10 10–––

Unsecured bank loans:

Euro floating rate 2.9 141 141–––

– effect of euro IR swaps* (0.4) (55) – 55 –

US dollar floating rate 4.7 162 162–––

– effect of US dollar IR swaps* 0.2 (87) 87 – –

Hong Kong dollar floating rate 4.7 71 71–––

Net debt 88 (82) 87 83 –

Effect of currency swaps:

Receive and pay fixed* (1.5) 33–––

Receive and pay floating (2.0) 22–––

93 (77) 87 83 –

* These items bear interest at a fixed rate.

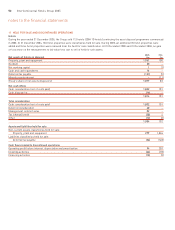

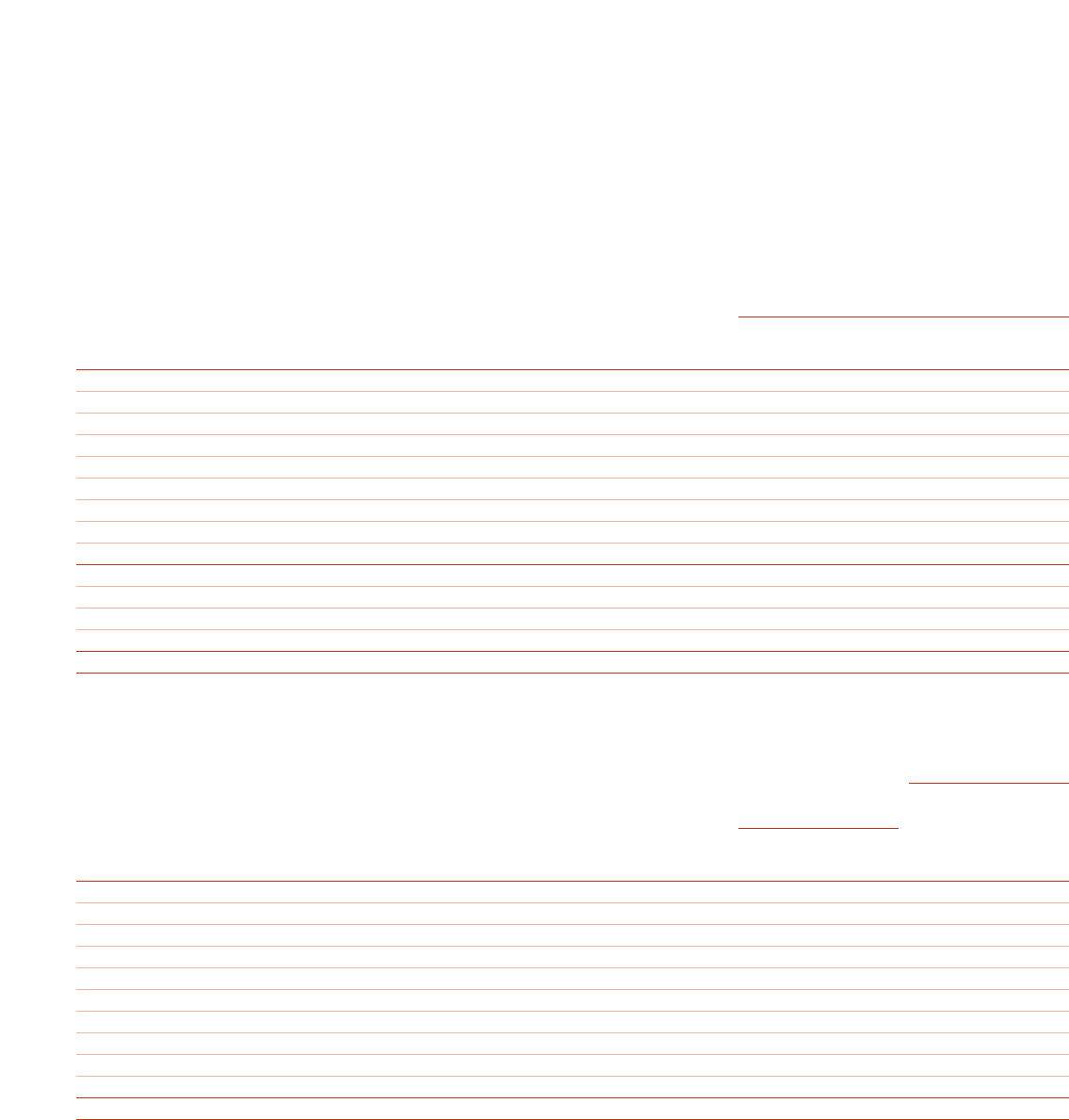

The interest rate profile of the Group’s material financial assets and liabilities, after taking account of the interest rate swap agreements

and currency swap agreements at 31 December 2004, was:

Interest at fixed rate

Weighted

average

Currency Principal Weighted period for

swap At variable At fixed average which rate

Net debt agreements Total rate* rate rate is fixed

31 December 2004 £m £m £m £m £m % (years)

Current asset investments and cash at bank and in hand:

Sterling 26339365365–––

US dollar 29–2929–––

Other 28 – 28 28–––

Borrowings:

Sterling (247) – (247) (244) (3) – 5.0

US dollar (283) (52) (335) (231) (104) 4.6 1.7

Euro (560) (239) (799) (596) (203) 3.6 1.0

Hong Kong dollar (69) – (69) (49) (20) 1.5 0.8

Other (40) (48) (88) (64) (24) 5.4 0.7

(1,116) – (1,116) (762) (354) 3.9 1.2

* Primarily based on the relevant inter-bank rate.

Trade and other receivables and trade and other payables are not included in the above tables as they are non-interest bearing and are

not subject to interest rate risk.

InterContinental Hotels Group 2005 59