Holiday Inn 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

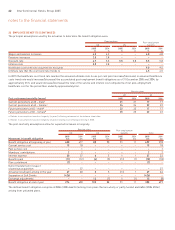

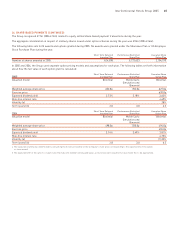

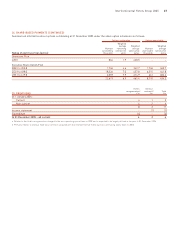

27 AUTHORISED AND ISSUED SHARE CAPITAL

Authorised (ordinary shares and redeemable preference share)

The Company was incorporated and registered in England and Wales with registered number 5134420 on 21 May 2004 as a limited company

under the Companies Act 1985 with the name Hackremco (No. 2154) Limited. On 24 March 2005, Hackremco (No. 2154) Limited changed its

name to New InterContinental Hotels Group Limited. On 27 April 2005, New InterContinental Hotels Group Limited re-registered as a public

limited company and changed its name to New InterContinental Hotels Group PLC. On 27 June 2005, New InterContinental Hotels Group

PLC changed its name to InterContinental Hotels Group PLC.

On 21 May 2004, the Company had an authorised share capital of £100, divided into 100 ordinary shares of £1 each, of which one ordinary

share was allotted, called up and fully paid on incorporation.

On 21 April 2005, the authorised share capital was increased to £50,100 by the creation of one redeemable preference share of £50,000.

The redeemable preference share so created was allotted and treated as paid up in full on this date.

On 20 May 2005, the authorised share capital of the Company was increased from £50,100 to £10,000,050,000 by the creation of 9,999,999,900

ordinary shares of £1 each. On 20 May 2005, all of the ordinary shares of £1 each were consolidated into ordinary shares of £6.25 each.

On 30 June 2005, £6.15 on every £6.25 ordinary share was cancelled, thereby reducing the nominal value of each ordinary share to 10p.

At 31 December 2005, the authorised share capital was £160,050,000, comprising 1,600,000,000 ordinary shares of 10p each and one

redeemable preference share of £50,000.

Number of

shares

Allotted, called up and fully paid (ordinary shares) note millions £m

At 1 January 2004 739 739

Share capital consolidation a(75) –

Issued under option schemes 44

Repurchased and cancelled under repurchase programmes b(46) (46)

At 31 December 2004 622 697

Issued under option schemes 11

Repurchased and cancelled under repurchase programmes b(19) (22)

Capital reorganisation c(161) (632)

Issued under option schemes 1–

Repurchased and cancelled under repurchase programmes b(11) (1)

At 31 December 2005 433 43

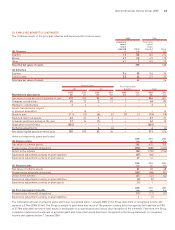

a On 10 December 2004, shareholders approved a share capital consolidation on the basis of 25 new ordinary shares for every 28 existing ordinary shares. This provided

for all the authorised ordinary shares of £1 each (whether issued or unissued) to be consolidated into new ordinary shares of 112p each. The share capital consolidation

became effective on 13 December 2004. The consolidation had no impact on the authorised redeemable preference share.

b During 2004 and 2005, the Company undertook to return funds of up to £750m to shareholders by way of three consecutive £250m share repurchase programmes,

the second of which is expected to be completed in the first half of 2006. During the year, 30,600,010 (2004 46,385,981) ordinary shares were repurchased and cancelled

under the authorities granted by shareholders at general meetings held during 2003, 2004 and 2005. Of these, 19,460,010 (2004 46,385,981) were 112p (2004 100p)

shares in the capital of InterContinental Hotels Limited (formerly InterContinental Hotels Group PLC) and 11,140,000 were 10p shares in the capital of InterContinental

Hotels Group PLC (formerly New InterContinental Hotels Group PLC).

c On 27 June 2005, the capital reorganisation (by means of a scheme of arrangement under Section 425 of the Companies Act 1985) was completed. Under the

arrangement, shareholders received 11 new ordinary shares and £24.75 cash in exchange for every 15 existing ordinary shares held on 24 June 2005. The entire issued

share capital of InterContinental Hotels Group PLC was transferred to New InterContinental Hotels Group PLC at fair market value, in exchange for the issue of

443 million fully paid ordinary shares of 10p each, which were admitted to the Official List of the UK Listing Authority and admitted to trading on the London Stock

Exchange on that date. In accordance with the merger relief provisions of Sections 131 and 133 of the Companies Act 1985, the 443 million shares are recorded only

at nominal value.

d On 8 September 2005, the redeemable preference share was redeemed at par value. The redeemable preference share did not carry any right to receive dividends nor

to participate in the profits of the Company.

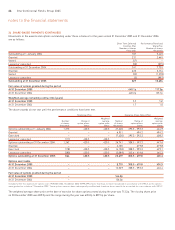

The authority given to the Company at the Annual General Meeting on 1 June 2005 to purchase its own shares was still valid at

31 December 2005. A resolution to renew the authority will be put to shareholders at the Annual General Meeting on 1 June 2006.

InterContinental Hotels Group 2005 69