Holiday Inn 2005 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

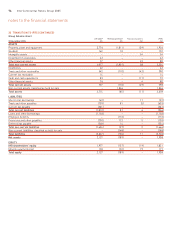

2005 2004

4 DEBTORS £m £m

Amounts due from subsidiary undertakings 131 –

Corporate taxation 6–

137 –

2005 2004

5 CREDITORS: AMOUNTS FALLING DUE WITHIN ONE YEAR £m £m

Amounts due to subsidiary undertakings 1,086 –

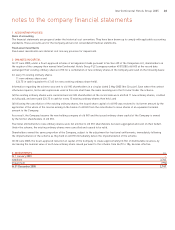

Number of shares

6 SHARE CAPITAL millions £m

Authorised (ordinary shares and redeemable preference share):

At 31 December 2004 (100 ordinary shares of £1 each) – –

One redeemable preference share (£50,000) a––

Increase in ordinary shares of £1 each b10,000 10,000

At 31 December 2005 10,000 10,000

Allotted, called up and fully paid:

At 31 December 2004 (one ordinary share of £1 each) ––

Issue of one redeemable preference share (£50,000) a––

Issue of 49 ordinary shares (£1 each) ––

Share capital consolidation (£6.25 each) b––

Ordinary shares issued to acquire IHG (£6.25 each) c443 2,767

Capital reduction (£6.25 to 10p each) d– (2,723)

Redemption of redeemable preference share (£50,000) e––

Issued under option schemes (10p each) 1–

Repurchase of shares (11) (1)

At 31 December 2005 433 43

a On 21 April 2005, the authorised share capital was increased to £50,100 by the creation of one redeemable preference share of £50,000. The redeemable preference

share so created was allotted and treated as paid up in full on this date.

b On 20 May 2005, the authorised share capital of the Company was increased from £50,100 to £10,000,050,000 by the creation of 9,999,999,900 ordinary shares of £1 each.

On 20 May 2005, all of the ordinary shares of £1 each were consolidated into ordinary shares of £6.25 each.

c On 27 June 2005, the Company issued 442,695,913 shares to acquire old IHG pursuant to the scheme (see note 2).

d On 30 June 2005, £6.15 on every £6.25 ordinary share was cancelled, thereby reducing the nominal value of each ordinary share to 10p, pursuant to the scheme.

e On 8 September 2005, the redeemable preference share was redeemed at par value. The redeemable preference share did not carry any right to receive dividends

nor to participate in the profits of the Company.

The aggregate consideration in respect of ordinary shares issued under option schemes during the year was £6m (2004 £nil).

Options to subscribe for ordinary shares thousands

At 31 December 2004 –

Options adopted as a result of capital reorganisation* 27,022

Exercised (2,997)

Lapsed or cancelled (542)

At 31 December 2005 23,483

Option exercise price per ordinary share (pence) 308.48 – 619.83

Final exercise date 4 April 2015

* All existing old IHG share option schemes were adopted by the Company when it became the new holding company of IHG on 27 June 2005.

The authority given to the Company at the Extraordinary General Meeting on 1 June 2005 to purchase its own shares was still valid at

31 December 2005. A resolution to renew the authority will be put to shareholders at the Annual General Meeting on 1 June 2006.

notes to the company financial statements

84 InterContinental Hotels Group 2005