Holiday Inn 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

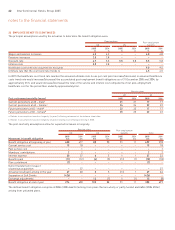

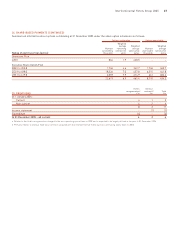

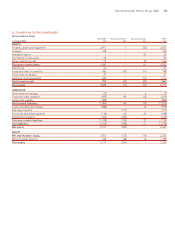

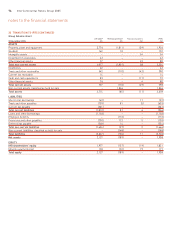

33 TRANSITION TO IFRS

Group income statement

UK GAAP Remeasurement IFRS

Year ended 31 December 2004 £m £m £m

Revenue 2,204 – 2,204

Cost of sales (1,477) – (1,477)

Administrative expenses (198) (10) (208)

529 (10) 519

Depreciation and amortisation (198) 25 (173)

Other operating income and expenses (29) (20) (49)

Operating profit 302 (5) 297

Financial income 70 – 70

Financial expenses (103) – (103)

Profit before tax 269 (5) 264

Tax 117 10 127

Profit after tax 386 5 391

(Loss)/gain on disposal of assets, net of tax (59) 78 19

Profit available for shareholders 327 83 410

Attributable to:

Equity holders of the parent 299 84 383

Minority equity interest 28 (1) 27

Profit for the year 327 83 410

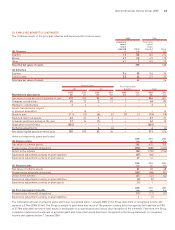

Income statement remeasurement

Administrative expenses Under UK GAAP, the cost of retirement benefits are provided based upon a consistent percentage of employees’

pensionable pay as recommended by independent qualified actuaries. Variations in regular pension costs are amortised over the average

expected service life of current employees on a straight line basis. Scheme assets and liabilities are not recognised on the Group’s balance

sheet. Under IFRS, the cost of providing defined benefit retirement benefits is recognised over the service life of scheme members. This

cost is calculated by an independent qualified actuary, based on estimates of long-term rates of return on scheme assets and discount

rates on scheme liabilities.

Under UK GAAP, the cost of share-based payments is expensed based on the intrinsic value method over the performance period of each

plan. Under IFRS, the fair value of all share-based payments is expensed over the vesting period of the related equity instruments, based

on the Group’s best estimate of the number of shares that will vest. Fair value is determined by an external valuer using option pricing

models applied to all share-based payments granted after 7 November 2002.

Depreciation and amortisation Under UK GAAP, goodwill is amortised over 20 years. Under IFRS, goodwill is subject to annual impairment

testing and is not amortised. Under IFRS, assets classified as held for sale are not subject to depreciation from the date the assets are

designated as held for sale.

Other operating income and expenses Under UK GAAP, impairment of property, plant and equipment is first recorded against the

revaluation reserve and then charged to the income statement. Under IFRS transitional rules, the Group elected to retain UK GAAP carrying

values of freehold and leasehold hotels including revaluations. All impairments are taken directly to the income statement.

Income tax expense Mainly attributable to tax on impairment of property, plant and equipment previously recorded against the revaluation

reserve under UK GAAP and the presentation of tax on disposal of assets.

(Loss)/gain on sale of assets Under IFRS, net asset carrying values have been reduced by the remeasurement of deferred tax, eliminating

the provision for loss on disposal of operations recognised under UK GAAP.

notes to the financial statements

72 InterContinental Hotels Group 2005