Holiday Inn 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

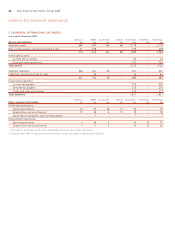

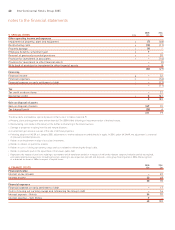

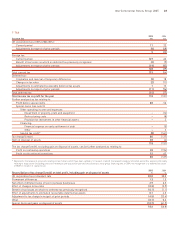

2005 2004

pence per pence per 2005 2004

8 DIVIDENDS PAID AND PROPOSED share share £m £m

Paid during the year:

Final (declared in previous year) 10.00 9.45 61 70

Interim 4.60 4.30 20 29

Special interim –72.00 –501

14.60 85.75 81 600

Proposed for approval at the Annual General Meeting (not recognised as a liability at 31 December):

Final 10.70 10.00 46 62

The proposed final dividend is payable on the shares in issue at 31 March 2006.

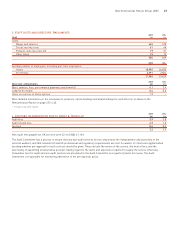

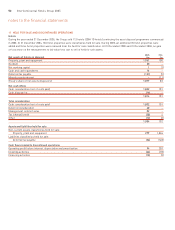

9 EARNINGS PER ORDINARY SHARE

Basic earnings per ordinary share is calculated by dividing the profit for the year available for IHG equity holders by the weighted average

number of ordinary shares, excluding investment in own shares, in issue during the year.

Diluted earnings per ordinary share is calculated by adjusting basic earnings per ordinary share to reflect the notional exercise of the

weighted average number of dilutive ordinary share options outstanding during the year. The resulting weighted average number of dilutive

ordinary shares is 533 million (2004 718 million).

Shareholder approval was given on 1 June 2005 to recommended proposals for the return of approximately £1bn to shareholders by way

of a capital reorganisation (by means of a Scheme of Arrangement under Section 425 of the Companies Act 1985). Under the arrangement,

shareholders received 11 new ordinary shares and £24.75 cash in exchange for every 15 existing ordinary shares held on 24 June 2005.

The overall effect of the transaction was that of a share repurchase at fair value, therefore no adjustment has been made to comparative data.

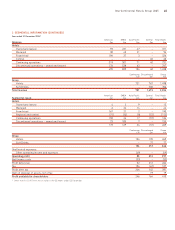

2005 2004

Continuing Continuing

operations Total operations Total

Basic earnings per share note £m £m £m £m

Profit available for equity holders 116 496 246 383

Basic weighted average number of ordinary shares (millions) 521 521 710 710

Basic earnings per share (pence) 22.3 95.2 34.6 53.9

Adjusted earnings per share

Profit available for equity holders 116 496 246 383

Less adjusting items:

Other operating income and expenses 522 22 49 49

Financing 5––11 11

Tax 5(8) (8) (183) (183)

Gain on disposal of assets, net of tax – (311) – (19)

Adjusted earnings 130 199 123 241

Basic weighted average number of ordinary shares (millions) 521 521 710 710

Adjusted earnings per share (pence) 24.9 38.2 17.3 33.9

Diluted earnings per share

Profit available for equity holders 116 496 246 383

Diluted weighted average number of ordinary shares (millions) (see below) 533 533 718 718

Diluted earnings per share (pence) 21.8 93.1 34.3 53.3

2005 2004

millions millions

Diluted weighted average number of ordinary shares is calculated as:

Basic weighted average number of ordinary shares 521 710

Dilutive potential ordinary shares – employee share options 12 8

533 718

Adjusted earnings per ordinary share is disclosed in order to show performance undistorted by special items, to give a more meaningful

comparison of the Group’s performance.

notes to the financial statements

50 InterContinental Hotels Group 2005