Holiday Inn 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

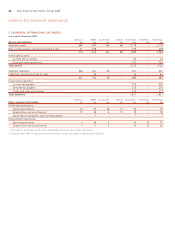

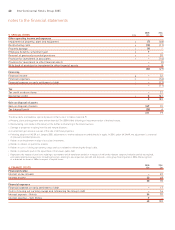

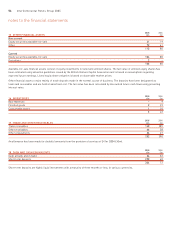

2005 2004

5 SPECIAL ITEMS note £m £m

Other operating income and expenses

Impairment of property, plant and equipment a(7) (48)

Restructuring costs b(13) (11)

Property damage c(9) –

Employee benefits curtailment gain d7–

Reversal of previously recorded provisions e–20

Provision for investment in associates f–(16)

Provision for investment in other financial assets –(2)

Write back of provision for investment in other financial assets –8

(22) (49)

Financing

Financial income g–22

Financial expenses h–(16)

Financial expense on early settlement of debt i–(17)

–(11)

Tax

Tax credit on above items –22

Special tax credit j8161

8183

Gain on disposal of assets

Gain on disposal of assets 349 15

Tax (charge)/credit (38) 4

311 19

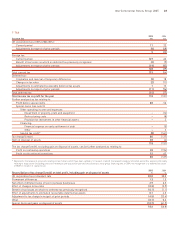

The above items are treated as special by reason of their size or incidence (see note 9).

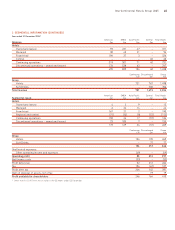

a Property, plant and equipment were written down by £7m (2004 £48m) following an impairment review of the hotel estate.

b Restructuring costs relate to the delivery of the further restructuring of the Hotels business.

c Damage to properties resulting from fire and natural disasters.

d A curtailment gain arose as a result of the sale of UK hotel properties.

e Following adoption of IAS 39 at 1 January 2005, adjustments to market value are recorded directly in equity. In 2004, under UK GAAP, the adjustment is a reversal

of previously recorded provisions.

f Relates to an impairment in value of associate investments.

g Relates to interest on special tax refunds.

h Relates to costs of closing out currency swaps and costs related to refinancing the Group’s debt.

i Relates to premiums paid on the repurchase of the Group’s public debt.

j Represents the release of provisions relating to tax matters which have been settled or in respect of which the relevant statutory limitation period has expired,

principally relating to acquisitions (including provisions relating to pre-acquisition periods) and disposals, intra-group financing and, in 2004, the recognition

of a deferred tax asset of £83m in respect of capital losses.

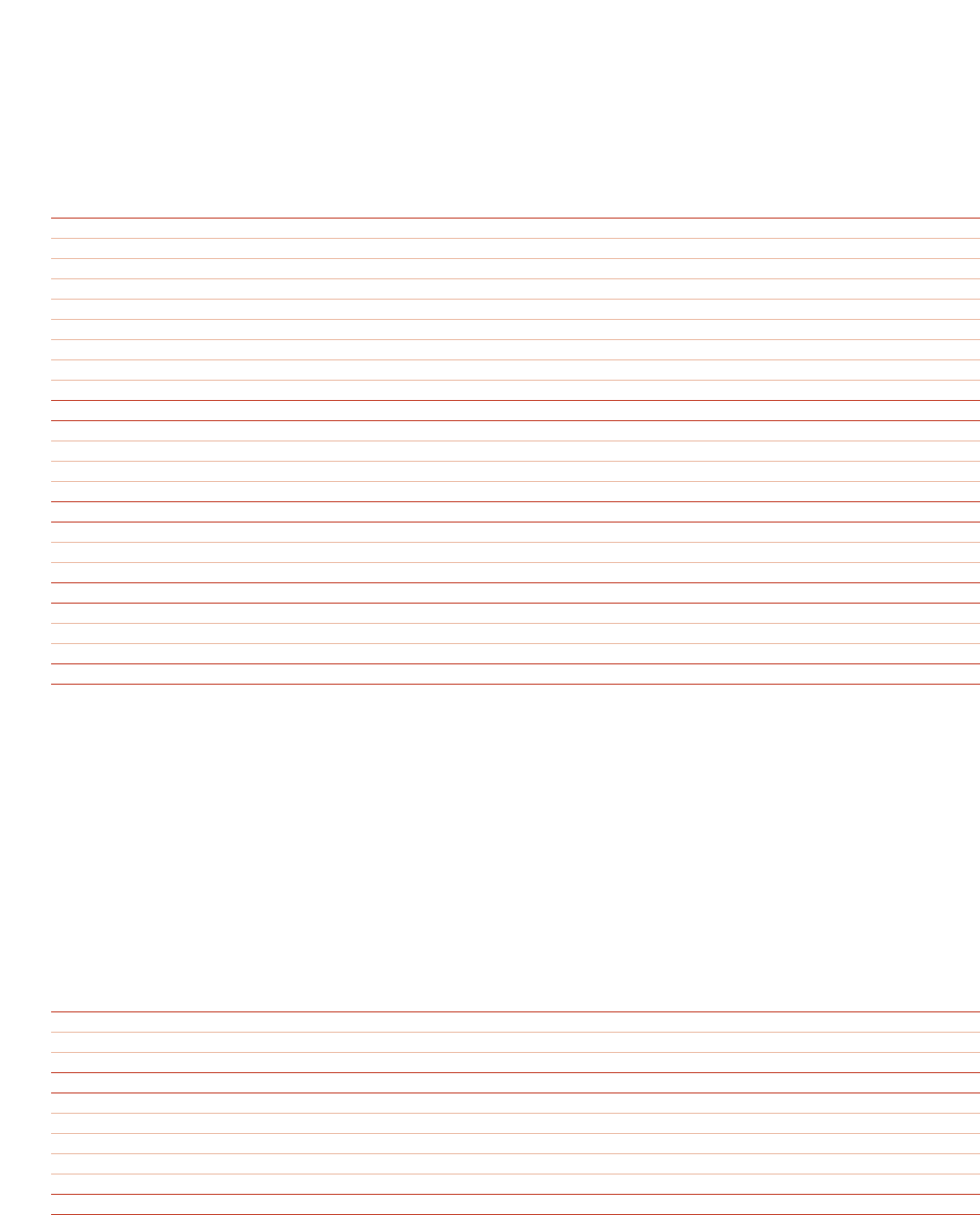

2005 2004

6 FINANCE COSTS £m £m

Financial income

Interest on tax refunds –22

Interest income 30 48

30 70

Financial expenses

Financial expense on early settlement of debt –17

Costs of closing out currency swaps and refinancing the Group’s debt –16

Interest expense – Hotels 54 70

Interest expense – Soft Drinks 9–

63 103

notes to the financial statements

48 InterContinental Hotels Group 2005