Holiday Inn 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

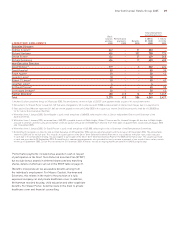

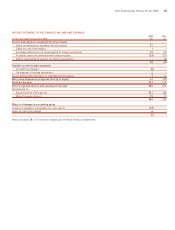

Total emoluments

Basic excluding pensions

salaries Performance 1.1.05 to 1.1.04 to

and fees payments Benefits 31.12.05 31.12.04

4 DIRECTORS’ EMOLUMENTS £000 £000 £000 £000 £000

Executive Directors

Andrew Cosslett1642 – 21 663 –

Richard Hartman 496 – 302 798 775

Stevan Porter2402 – 27 429 368

Richard Solomons 406 – 17 423 400

Non-Executive Directors

David Webster3519–3522 424

David Kappler480––80 35

Ralph Kugler550––50 42

Jennifer Laing518––18 –

Robert C Larson550––50 42

Jonathan Linen54––4–

Sir David Prosser665––65 50

Sir Howard Stringer550––50 42

Former Directors7488 413 16 917 1,249

Total 3,270 413 386 4,069 3,427

1 Andrew Cosslett joined the Group on 3 February 2005. The emoluments shown include a £53,737 cash payment made as part of his recruitment terms.

2 Emoluments for Stevan Porter include £41,140 that were chargeable to UK income tax and £19,088 reimbursement of interest and charges due to a payroll error.

3 Fees paid to David Webster represent £41,667 per month payable to him until 2 May 2005 in his capacity as interim Chief Executive and a fixed fee of £350,000 pa

for his role as Non-Executive Chairman.

4 With effect from 1 January 2005, David Kappler is paid a total annual fee of £80,000, reflecting his roles as Senior Independent Director and Chairman of the

Audit Committee.

5 With effect from 1 January 2005, an annual fee of £50,000 is payable to each of Ralph Kugler, Robert C Larson and Sir Howard Stringer. All fees due to Ralph Kugler

are paid to Unilever. Jennifer Laing and Jonathan Linen are paid an annual fee of £50,000 each effective from their dates of appointment, respectively 25 August 2005

and 1 December 2005.

6 With effect from 1 January 2005, Sir David Prosser is paid a total annual fee of £65,000, reflecting his role as Chairman of the Remuneration Committee.

7 Richard North resigned as a Director and as Chief Executive on 30 September 2004 and ceased employment with the Group on 31 December 2004. The emoluments

shown for 2004 are for the full year. This includes his participation in the Short Term Deferred Incentive Plan which, in accordance with plan rules, had to be paid

in cash due to his employment ending. He was eligible to participate in the Short Term Deferred Incentive Plan for the 2005 performance year. This award was made

in cash and pro-rated to 30 September 2005. Richard North’s severance arrangements also provided for him to receive a payment of one month’s basic salary in each

month up to September 2005. Sir Ian Prosser retired on 31 December 2003. However, he had an ongoing healthcare benefit of £840 during the year.

InterContinental Hotels Group 2005 29

‘Performance payments’ include bonus awards in cash in respect

of participation in the Short Term Deferred Incentive Plan (STDIP)

but exclude bonus awards in deferred shares and any matching

shares, details of which are set out in the STDIP table on page 31.

‘Benefits’ incorporate all tax assessable benefits arising from

the individual’s employment. For Messrs Cosslett, Hartman and

Solomons, this relates in the main to the provision of a fully

expensed company car and private healthcare cover. In addition,

Mr Hartman received housing, child education and other expatriate

benefits. For Stevan Porter, benefits relate in the main to private

healthcare cover and financial counselling.