Holiday Inn 2005 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

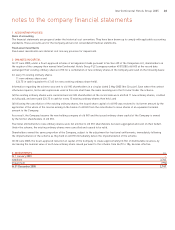

The Group recognises a profit on disposal of property, plant and

equipment provided substantially all the risks and rewards of

ownership have transferred. For the purposes of US GAAP, the

Group accounts for sales of real estate in accordance with FAS 66

‘Accounting for Sales of Real Estate’. If there is significant

continuing involvement with the property, any gain on sale is

deferred and recognised over the life of the long-term

management contract retained on the property.

Prior to the IFRS transition date, cumulative foreign currency

exchange gains and losses relating to the disposal of foreign

operations were adjusted within equity. Since 1 January 2004,

foreign currency gains and losses are included in determining the

profit or loss on disposal of foreign operations. At that date, the

Group opted to set the currency translation reserve to nil. Under

US GAAP, such gains and losses are also included in determining

the profit or loss on disposal but are tracked from the date of

acquisition of the foreign operation.

STAFF COSTS

The Group provides certain compensation arrangements in the

United States through a Rabbi Trust. Under IFRS, the net deficit

is recorded as a provision and the net change in the underlying

value of the assets and liabilities is recorded as a charge (or credit)

to the income statement. Under US GAAP, the marketable

securities held by the Rabbi Trust are accounted for in accordance

with FAS 115 ‘Accounting for certain investments in Debt and Equity

Securities’. The trust is shown gross in the balance sheet. The

marketable securities held by the trust are recorded at market

value and unrealised gains and losses are reported in other

comprehensive income except for other than temporary

movements which are recognised in the income statement.

DEFERRED TAX

The Group provides for deferred tax in respect of all temporary

differences between the tax base and carrying value of assets

and liabilities. Those temporary differences recognised include

accelerated capital allowances, unrelieved tax losses, unremitted

profits from overseas where the Group does not control remittance,

gains rolled over into replacement assets, gains on previously

revalued properties and other short-term temporary differences.

Under US GAAP, deferred tax is computed on all temporary

differences between the tax bases and book values of assets and

liabilities which will result in taxable or tax deductible amounts

arising in future years. Deferred tax assets under IFRS are recognised

to the extent that it is regarded as probable that the deductible

temporary differences can be utilised. Under US GAAP, deferred tax

assets are recognised in full and a valuation allowance is made to

the extent that it is not more likely than not that they will be realised.

Under IFRS, a deductible temporary difference arises in respect

of estimated future tax deductions on share-based payments based

upon the share price at the balance sheet date. Any excess of the

asset recognised over the cumulative compensation expense

recorded in the income statement multiplied by the statutory tax

rate is recorded directly in equity. Under US GAAP, a deferred tax

asset in respect of future deductible amounts is calculated only to

the extent of the cumulative compensation expense recorded to

date in the income statement. Where actual tax deductions received

upon exercise exceed the amount of any deferred tax asset the

excess is recorded in equity. Where actual tax deductions are less

than the deferred tax asset, the write-down of the asset is recorded

against equity to the extent of previous tax benefits recorded in this

account with any remainder recorded in the income statement.

DERIVATIVE FINANCIAL INSTRUMENTS AND HEDGING

The Group enters into derivative instruments to limit its exposure

to interest rate and foreign exchange risk. In 2004 under IFRS

transitional provisions, these instruments were measured at cost

and accounted for as hedges, whereby gains and losses were

deferred until the underlying transaction occurred. Under US GAAP,

all derivative instruments (including those embedded in other

contracts) are recognised on the balance sheet at their fair values.

Changes in fair value are recognised in net income unless specific

hedge criteria are met. The Group adopted both IAS 32 ‘Financial

Instruments: Disclosure and Presentation’ and IAS 39 ‘Financial

Instruments: Recognition and Measurement’ from 1 January 2005.

There is now no difference between IFRS and US GAAP with regard

to derivatives entered into after 1 January 2005.

GUARANTEES

The Group gives guarantees in connection with obtaining long-term

management contracts. Under IFRS, a contingent liability is not

recognised. For the purposes of US GAAP, under Financial

Accounting Standards Board Interpretation (FIN) 45 ‘Guarantors

Accounting and Disclosure Requirements for Guarantees, Including

Direct Guarantees of Indebtedness of Others in the Year’, at the

inception of guarantees issued after 31 December 2002, the Group

records the fair value of such guarantees as an asset and liability,

which are amortised over the life of the contract.

ASSETS AND LIABILITIES HELD FOR SALE

Under IFRS, assets and liabilities are classified as held for sale

when the criteria under IFRS 5 ‘Non-current Assets Held for Sale

and Discontinued Operations’ are met. Under US GAAP, similar

criteria are applied to held for sale assets. However, FAS 66

‘Accounting for Sales of Real Estate’ excludes any assets from

being included as held for sale where there will be a continuing

involvement in the asset.

DISCONTINUED OPERATIONS

Under IFRS, the results of operations arising from assets classified

as held for sale are classified as discontinued operations when the

results relate to a separate line of business or geographical area of

operations; or where there is a co-ordinated plan to dispose of a

separate line of business or geographical area of operations. Under

US GAAP, operations are classified as discontinued when they are

classified as held for sale and when the Group no longer believes

it will have a significant continuing involvement.

InterContinental Hotels Group 2005 77