Holiday Inn 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

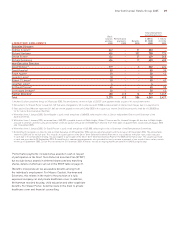

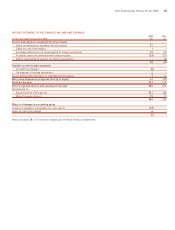

5 LONG-TERM REWARD

PERFORMANCE RESTRICTED SHARE PLAN (PRSP)

In 2005, there were three cycles in operation and one cycle which vested.

The awards made in respect of the Performance Restricted Share Plan cycles ending on 31 December 2004, 31 December 2005,

31 December 2006 and 31 December 2007 and the maximum pre-tax number of ordinary shares due if performance targets are

achieved in full are set out in the table below. In respect of the cycle ending on 31 December 2005, the Company finished in fifth place

in the TSR group and achieved ROCE growth of 46%. Accordingly, 42.8% of the award will vest on 3 March 2006.

Maximum Maximum Expected

PRSP PRSP value value

shares shares based based

Maximum awarded vested Maximum on share on share

PRSP during Market during Market Actual/ PRSP price of price of

shares the year price per the year price per Value at planned shares 839.5p at 839.5p at

held at 1.1.05 to Award share at 1.1.05 to share at vesting vesting held at 31.12.05 31.12.05

Directors 1.1.05 31.12.05 date award 31.12.05 vesting £ date 31.12.05 £ £

Andrew Cosslett 68,21621.4.05 617.5p – 3.3.06 68,216 572,674 245,1058

136,43231.4.05 617.5p – 9.3.07 136,432 1,145,347

276,200429.6.05 706p – 7.3.08 276,200 2,318,699

Total 480,848 4,036,720

Richard Hartman 111,930118.6.03 445p 67,158 660p 443,243 11.3.05 –

167,900218.6.03 445p – 3.3.06 167,900 1,409,521 603,2758

165,130324.6.04 549.5p – 9.3.07 165,130 1,386,267

214,870429.6.05 706p – 7.3.08 214,870 1,803,834

Total 547,900 4,599,622

Stevan Porter 113,810118.6.03 445p 68,286 660p 450,688711.3.05 –

170,710218.6.03 445p – 3.3.06 170,710 1,433,111 613,3728

142,290324.6.04 549.5p – 9.3.07 142,290 1,194,525

174,900429.6.05 706p – 7.3.08 174,900 1,468,286

Total 487,900 4,095,922

Richard Solomons 110,110118.6.03 445p 66,066 660p 436,036 11.3.05 –

165,160218.6.03 445p – 3.3.06 165,160 1,386,519 593,4318

144,990324.6.04 549.5p – 9.3.07 144,990 1,217,192

176,550429.6.05 706p – 7.3.08 176,550 1,482,138

Total 486,700 4,085,849

Former Directors

Richard North 188,760118.6.03 445p 113,256 660p 747,490 11.3.05 –

283,1402, 5 18.6.03 445p – 3.3.06 259,54542,178,881 932,5628

248,5603, 5 24.6.04 549.5p – 9.3.07 144,99341,217,217

Total 404,538 3,396,098

Sir Ian Prosser 65,4101, 6 18.6.03 445p 39,246 660p 259,024 11.3.05 –

65,4102, 6 18.6.03 445p – 3.3.06 65,410 549,117 235,0238

Total 65,410 549,117

Total 20,763,328

1 This ‘transitional’ award was based on performance to 31 December 2004 where the performance measure related to the Company’s Total Shareholder Return (TSR)

against a group of 11 other comparator companies. The number of shares released was graded, according to where the Company finished in the comparator group, with

100% of the award being released for first or second position and 20% of the award being released for sixth place. The Company finished in fourth place and accordingly

60% of the award vested on 11 March 2005.

2 This award is based on performance to 31 December 2005 where the performance measure relates to both the Company’s TSR against a group of 11 other comparator

companies and growth in return on capital employed (ROCE). The number of shares released is graded, according to a) where the Company finishes in the TSR

comparator group, with 50% of the award being released for first or second position and 10% of the award being released for sixth place; and b) growth in ROCE, with

50% of the award being released for 80% growth and 10% of the award being released for 30% growth.

3 This award is based on performance to 31 December 2006 where the performance measure relates to both the Company’s TSR against a group of 10 other comparator

companies and growth in ROCE.

4 This award is based on performance to 31 December 2007 where the performance measure relates to both the Company’s TSR against a group of 10 other comparator

companies and cumulative annual growth of rooms in the IHG system against a group of nine other comparator companies.

5 Richard North’s awards were pro-rated to reflect his contractual service during the applicable performance periods.

6 Sir Ian Prosser’s awards were pro-rated to reflect his actual service during the applicable performance periods.

7 The value of Stevan Porter’s shares at vesting includes £43,190 that was chargeable to UK income tax.

8 The Company finished in fifth place in the TSR group and achieved ROCE growth of 46%. Accordingly, 42.8% of the award will vest on 3 March 2006.

remuneration report

30 InterContinental Hotels Group 2005