Holiday Inn 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

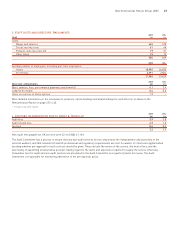

REVENUE RECOGNITION

Revenue is derived from the following sources: owned and leased

properties; management fees; franchise fees; sale of soft drinks

and other revenues which are ancillary to the Group’s operations.

Generally, revenue represents sales (excluding VAT and similar

taxes) of goods and services, net of discounts, provided in the

normal course of business and recognised when services have

been rendered. The following is a description of the composition

of revenues of the Group.

Owned and leased – primarily derived from hotel operations,

including the rental of rooms and food and beverage sales from a

worldwide network of owned and leased hotels operated under the

Group’s brand names. Revenue is recognised when rooms are

occupied and food and beverages are sold.

Management fees – earned from hotels managed by the Group,

usually under long-term contracts with the hotel owner. Management

fees include a base fee, which is generally a percentage of hotel

revenue, and an incentive fee, which is generally based on the

hotels’ profitability or cash flows. Revenue is recognised when

earned and realised or realisable under the terms of the contract.

Franchise fees – received in connection with the license of the

Group’s brand names, usually under long-term contracts with

the hotel owner. The Group charges franchise royalty fees as a

percentage of room revenue. Revenue is recognised when earned

and realised or realisable.

SHARE-BASED PAYMENTS

The cost of equity-settled transactions with employees is measured

by reference to fair value at the date at which the shares are

granted. Fair value is determined by an external valuer using

option pricing models.

The cost of equity-settled transactions is recognised, together with

a corresponding increase in equity, over the period in which any

performance conditions are fulfilled, ending on the date on which the

relevant employees become fully entitled to the award (vesting date).

The income statement charge for a period represents the

movement in cumulative expense recognised at the beginning and

end of that period. No expense is recognised for awards that do not

ultimately vest, except for awards where vesting is conditional upon

a market condition, which are treated as vesting irrespective of

whether or not the market condition is satisfied, provided that all

other performance conditions are satisfied.

The Group has taken advantage of the transitional provisions of

IFRS 2 in respect of equity-settled awards and has applied IFRS 2

only to equity-settled awards granted after 7 November 2002 that

had not vested before 1 January 2005.

LEASES

Operating lease rentals are charged to the income statement on

a straight line basis over the term of the lease.

DISPOSAL OF ASSETS

The Group recognises the sales proceeds and related profit or loss

on disposal on completion of the sales process. The Group considers

the following criteria in determining whether revenue and profit or

loss should be recorded:

• does the Group have a continuing managerial involvement to

the degree associated with asset ownership;

• has the Group transferred the significant risks and rewards

associated with asset ownership;

• can the Group reliably measure the proceeds; and

• will the Group actually receive the proceeds.

DISCONTINUED OPERATIONS

The results of operations arising from assets classified as held

for sale are classified as discontinued operations when the

results relate to a separate line of business, geographical area

of operations, or where there is a co-ordinated plan to dispose of

a separate line of business or geographical area of operations.

USE OF ESTIMATES

The preparation of financial statements requires management to

make estimates and assumptions that affect the reported amounts

of assets and liabilities, disclosure of contingent assets and

liabilities at the date of the financial statements and the reported

amounts of revenues and expenses during the reporting period.

On an ongoing basis, management evaluates its estimates and

judgements, including those relating to revenue recognition,

allowance for doubtful amounts, associates and financial assets,

property, plant and equipment, goodwill, intangible assets, income

taxes, financial instruments, hotel loyalty programme, self-

insurance, employee benefits and contingencies and litigation.

Management bases its estimates and judgements on historical

experience and on various other factors that are believed to be

reasonable under the circumstances, the results of which form the

basis for making judgements about the carrying value of assets

and liabilities that are not readily available from other sources.

Actual results may differ from these estimates under different

assumptions and conditions.

NEW STANDARDS AND INTERPRETATIONS

During the year, the International Accounting Standards Board (IASB)

and International Financial Reporting Interpretations Committee

(IFRIC) issued the following standards and interpretations with an

effective date after the date of these financial statements. These

standards and interpretations which are relevant to the Group have not

been applied in the preparation of the Group’s financial statements:

• IFRS 7 Financial Instruments: Disclosures

Effective from 1 January 2007

• IFRIC 4 Determining whether an arrangement

contains a lease

Effective from 1 January 2006

The Group does not anticipate that the adoption of these standards

and interpretations will have a material impact on the Group’s

financial statements on adoption.

InterContinental Hotels Group 2005 41