Holiday Inn 2005 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIGNIFICANT DEVELOPMENTS

Britvic Initial Public Offering

In December 2005, IHG disposed of all of its interests in the Britvic

Group (Britvic), by way of an initial public offering (IPO) of Britvic

plc. IHG received approximately £371m in proceeds and additional

dividends, before transaction costs. The disposal of Britvic leaves

the Group focused solely on the hotel business. The results of

Britvic up to 14 December 2005 are included in the Group results.

Hotel Disposals

During 2005, IHG made significant further progress in its asset

disposal programme, including:

• the sale of 13 hotels in the US, Canada and Puerto Rico to

Hospitality Properties Trust (HPT) for $425m before transaction

costs. Completion of the sale on 12 hotels was on 16 February

2005, with the sale of the InterContinental Hotel in Austin, Texas

completing on 1 June 2005. IHG entered into a management

contract with HPT on 12 of the hotels and operates the

InterContinental San Juan on a lease agreement;

• the acquisition by Strategic Hotels Capital, Inc. (SHC) of an

85% interest in the InterContinental Miami and InterContinental

Chicago, for $287m in cash before transaction costs. The

acquisition completed on 1 April 2005 and IHG entered into

a management agreement with SHC on both of the hotels;

• the sale of 73 hotels in the UK to LRG Acquisition Limited (LRG),

a consortium comprising Lehman Brothers Real Estate Partners,

GIC Real Estate and Realstar Asset Management. The transaction

completed on 24 May 2005, with IHG receiving an initial £960m in

cash before transaction costs with a further £40m to be received

subject to meeting performance targets over the next three years.

IHG entered into a management agreement with LRG on 63 of the

hotels and operates the other ten hotels under a temporary

management agreement;

• the sale of nine hotels in Australia and New Zealand to Eureka

Funds Management Ltd (Eureka) for A$390m in cash before

transaction costs, and the sale of the Holiday Inn, Suva, to a

subsidiary of Fiji National Provident Fund (FNPF) for A$15m in

cash. Both transactions completed by 31 October 2005, with IHG

entering into management agreements with Eureka and FNPF

on these hotels;

• the sale of the InterContinental Hotel Paris for €315m.

The transaction completed on 1 November 2005 and the hotel

left the IHG system; and

• the sale of a further 13 hotels for proceeds of approximately

£159m.

Since the end of 2005, the Group has made further announcements

in relation to hotel disposals:

• on 25 January 2006, the sale to HPT of two hotels in the Americas

for $35m, marginally below net book value; and

• on 31 January 2006, the Group announced that it had placed a

further 31 hotels in Europe on the market. The book value of

these hotels is approximately £600m, and constitutes the final

tranche of hotels that the Group had previously announced it

would sell.

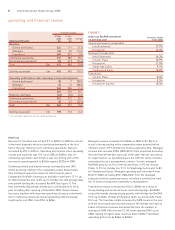

The asset disposal programme which commenced in 2003 has

significantly reduced the capital intensity of the Group whilst

largely retaining the hotels in the system via management and

franchise agreement.

Since the separation of Six Continents PLC in April 2003 (Separation),

the Group has sold or announced the sale of 144 hotels for

aggregate proceeds of approximately £2.3bn (see figure 3). Of these

144 hotels, 126 have remained in the system under Group brands

through either franchise or management agreements.

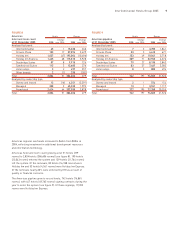

FelCor Relationship

On 25 January 2006, the Group announced a restructured

management agreement with FelCor Lodging Trust Inc., (FelCor),

covering all of the hotels (15,790 rooms) owned by FelCor and

managed by the Group. Seventeen hotels (6,301 rooms) will be

retained by FelCor and managed by the Group, with revised

contract terms (duration extended to 2025) and rebased incentive

fees on all the hotels. HPT have purchased seven of the hotels

(2,072 rooms) from FelCor for $160m, retaining the Group flag on

these assets. There is no increase in the guarantees to HPT as a

result of this deal. Nine further hotels (2,463 rooms) can be sold

by FelCor, retaining a Group brand. FelCor has the right to sell or

convert a further 15 hotels (4,954 rooms); these may retain the

Group flag.

Since the year end, the Group has sold its entire shareholding

in FelCor for $191m in cash.

InterContinental Hotels Group 2005 3