Holiday Inn 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

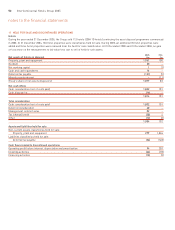

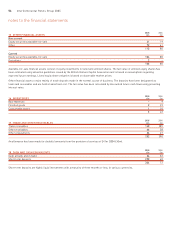

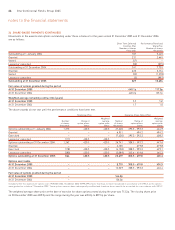

21 FINANCIAL RISK MANAGEMENT POLICIES

Financial instruments

The Group’s treasury policy is to manage financial risks that arise

in relation to underlying business needs. The activities of the

treasury function are carried out in accordance with Board approved

policies and are subject to regular audit. The treasury function

does not operate as a profit centre.

The treasury function seeks to reduce the financial risk of the

Group and manages liquidity to meet all foreseeable cash needs.

Treasury activities include money market investments, spot and

forward foreign exchange instruments, currency options, currency

swaps, interest rate swaps and options and forward rate

agreements. One of the primary objectives of the Group’s treasury

risk management policy is to mitigate the adverse impact of

movements in interest rates and foreign exchange rates.

Movements in foreign exchange rates, particularly the US dollar

and euro, can affect the Group’s reported profit, net assets and

interest cover. To hedge this translation exposure as far as is

reasonably practical, borrowings are taken out in foreign

currencies (either directly or via currency swaps) which broadly

match those in which the Group’s major net assets are

denominated.

Foreign exchange transaction exposure is managed by the forward

purchase or sale of foreign currencies or the use of currency

options. Most significant exposures of the Group are in currencies

that are freely convertible.

Interest rate exposure is managed within parameters that stipulate

that fixed rate borrowings should normally account for no less than

25% and no more than 75% of net borrowings for each major

currency. This is achieved through the use of interest rate swaps

and options and forward rate agreements.

Credit risk on treasury transactions is minimised by operating a

policy on the investment of surplus funds that generally restricts

counterparties to those with an A credit rating or better, or those

providing adequate security. Limits are also set for individual

counterparties. Most of the Group’s surplus funds are held in the

UK or US and there are no material funds where repatriation is

restricted as a result of foreign exchange regulations.

The Group is in compliance with all of the financial covenants

in its loan documentation, none of which is expected to represent

a material restriction on funding or investment policy in the

foreseeable future.

Medium and long-term borrowing requirements are met through

the Syndicated facility. Short-term borrowing requirements are met

from drawings under bilateral bank facilities.

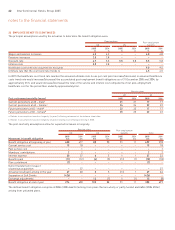

Sensitivities

Based on the year end net debt position and given the underlying

maturity profile of investments, borrowings and hedging

instruments at that date, a one percentage point rise in US dollar

interest rates would increase the net interest charge by

approximately £1m, whilst a similar movement in euro interest

rates would increase the net interest charge by approximately £4m.

A general weakening of the US dollar (specifically a one cent rise

in the sterling:US dollar rate) would have reduced the Group’s

profit before tax by an estimated £1m.

Hedging

Interest rate risk The Group hedges its interest rate risk by taking

out interest rate swaps to fix the interest flows on between 25%

and 75% of its borrowings in major currencies. At 31 December

2005, the Group held interest rate swaps with notional principals

of USD200m and EUR160m (2004 USD200m, AUD60m, HKD300m

and EUR215m). The interest rate swaps are designated as cash

flow hedges of the syndicated loan facility and they are held on

the balance sheet at fair value in other financial assets and

other payables.

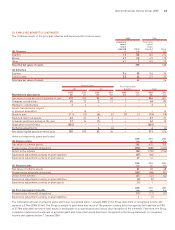

Foreign currency risk The Group is exposed to foreign currency

risk on income streams denominated in foreign currencies. The

Group hedges a portion of forecast foreign currency income and

asset disposal proceeds by taking out forward exchange contracts

designated as cash flow hedges. The spot foreign exchange rate is

designated as the hedged risk and so the Group takes the forward

points on these contracts through financial expenses. The forward

contracts all have maturities of less than one year from the

balance sheet date.

Forward contracts are held at fair value on the balance sheet as

other financial assets and other payables.

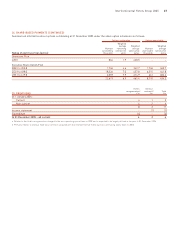

Changes in cash flow hedge fair values are recognised in the

unrealised gains and losses reserve to the extent that the hedges

are effective. When the hedged item is recognised, the cumulative

gains and losses on the hedging instrument are recycled to the

income statement.

During the year, £1.3m of interest on forward contracts was

recognised through financial income and a £4.6m net foreign

exchange gain was recognised in the income statement, recycled

against the appropriate hedged items.

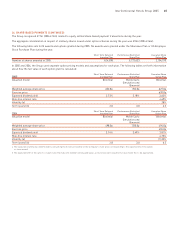

Hedge of net investment in a foreign operation The Group

designates its foreign currency bank borrowings and currency

swaps as net investment hedges of foreign operations. The

designated risk is the spot foreign exchange risk; the interest on

these financial instruments is taken through financial expenses

and the swaps are held on the balance sheet at fair value in other

financial assets and other payables. Variations in fair value due to

changes in the underlying exchange rates are taken to the currency

translation reserve until an operation is sold, at which point the

cumulative currency gains and losses are recycled against the gain

or loss on sale.

notes to the financial statements

58 InterContinental Hotels Group 2005