Holiday Inn 2005 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

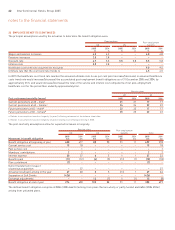

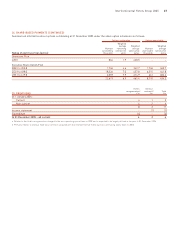

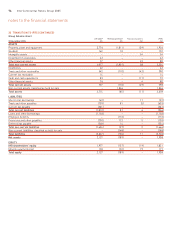

Other

Property, Deferred short-term

plant and gains on Employee Intangible temporary

equipment loan notes Losses benefits assets differences* Total

26 DEFERRED TAX PAYABLE £m £m £m £m £m £m £m

At 1 January 2004 519 123 (37) (42) (37) (49) 477

Disposals (5)–––––(5)

Income statement (17) – (77) 17 5 (5) (77)

Statement of recognised income and expense – – – (14) – – (14)

Exchange and other adjustments (5) (1) 1 – 2 4 1

At 31 December 2004 492 122 (113) (39) (30) (50) 382

Disposals (150) – – 34 – 3 (113)

Income statement (87) – (11) (5) 32 56 (15)

Statement of recognised income and expense – – – (5) – (2) (7)

Exchange and other adjustments 1 – 1 (1) (3) (1) (3)

At 31 December 2005 256 122 (123) (16) (1) 6 244

* Other short-term temporary differences relate primarily to provisions and accruals, investments in associates and joint ventures and share-based payments.

2005 2004

£m £m

Analysed as:

Deferred tax payable 210 234

Liabilities classified as held for sale 34 148

At 31 December 244 382

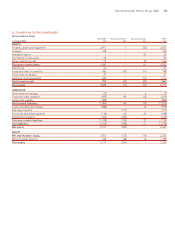

The deferred tax asset of £123m (2004 £113m) recognised in respect of losses includes £89m (2004 £89m) of capital losses available to be

utilised against the realisation of capital gains which are recognised as a deferred tax liability and £34m (2004 £24m) in respect of revenue

tax losses.

Tax losses with a value of £282m (2004 £305m), including capital losses with a value of £93m (2004 £98m), have not been recognised as

their use is uncertain or not currently anticipated. These losses may be carried forward indefinitely.

Deferred tax assets of £19m (2004 £4m) in respect of share-based payments, £7m (2004 £10m) in respect of employee benefits and £11m

(2004 £nil) in respect of other items have not been recognised as their use is uncertain or not currently anticipated.

At 31 December 2005, the Group has not provided deferred tax in relation to temporary differences associated with undistributed earnings

of subsidiaries. Quantifying the temporary differences is not practical. However, based on current enacted law and on the basis that the

Group is in a position to control the timing and realisation of these temporary differences, no material tax consequences are expected

to arise.

notes to the financial statements

68 InterContinental Hotels Group 2005