Holiday Inn 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

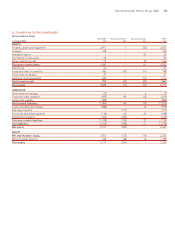

1 ACCOUNTING POLICIES

Basis of accounting

The financial statements are prepared under the historical cost convention. They have been drawn up to comply with applicable accounting

standards. These accounts are for the Company and are not consolidated financial statements.

Fixed asset investments

Fixed asset investments are stated at cost less any provision for impairment.

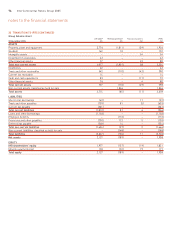

2 CHANGES IN CAPITAL

On 27 June 2005, under a Court-approved scheme of arrangement made pursuant to Section 425 of the Companies Act, shareholders on

the register of the company then named InterContinental Hotels Group PLC (company number 4551528) (old IHG) at the record date

exchanged their existing ordinary shares in IHG for a combination of new ordinary shares in the Company and cash on the following basis:

for every 15 existing ordinary shares

11 new ordinary shares and

£24.75 in cash (equivalent to £1.65 for every existing ordinary share held).

Information regarding the scheme was sent to old IHG shareholders in a circular dated 3 May 2005 (the Circular). Save where the context

otherwise requires, terms and expressions used in this note shall have the same meaning as in the Circular. Under the scheme:

(a) the existing ordinary shares were cancelled and old IHG shareholders at the record date were allotted 11 new ordinary shares, credited

as fully paid, and were paid £24.75 in cash for every 15 existing ordinary shares then held; and

(b) following the cancellation of the existing ordinary shares, the issued share capital of old IHG was restored to its former amount by the

application of the whole of the reserve arising in the books of old IHG from the cancellation to issue shares of an equivalent nominal

amount to the Company.

As a result, the Company became the new holding company of old IHG and the issued ordinary share capital of the Company is owned

by the former shareholders in old IHG.

Fractional entitlements to new ordinary shares were not allotted to old IHG shareholders but were aggregated and sold on their behalf.

Under the scheme, the existing ordinary shares were cancelled and ceased to be valid.

Shareholders owned the same proportion of the Company, subject to the adjustment for fractional entitlements, immediately following

the implementation of the scheme as they held in old IHG immediately before the implementation of the scheme.

On 30 June 2005, the Court-approved reduction of capital of the Company to create approximately £2.7bn of distributable reserves, by

decreasing the nominal value of each new ordinary share issued pursuant to the scheme from £6.25 to 10p, became effective.

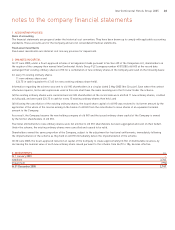

3 INVESTMENTS £m

At 1 January 2005 –

Additions 3,763

Impairment (996)

At 31 December 2005 2,767

notes to the company financial statements

InterContinental Hotels Group 2005 83