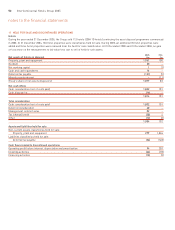

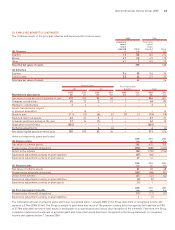

Holiday Inn 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

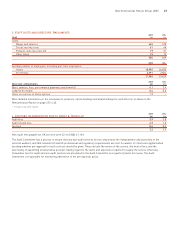

2005 2004

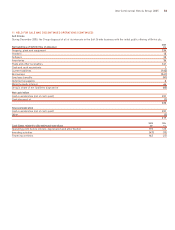

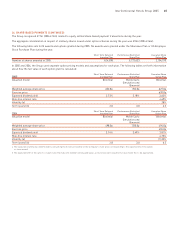

19 TRADE AND OTHER PAYABLES £m £m

Current

Trade payables 84 159

Other tax and social security payable 12 50

Other payables 174 187

Accruals 186 232

Derivatives 6–

Provisions (see note 25) 65

468 633

Non-current

Other payables 107 97

Provisions (see note 25) –6

107 103

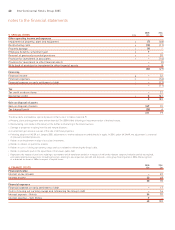

31 December 2005 31 December 2004

Due within Due after Due within Due after

1 year 1 year Total 1 year 1 year Total

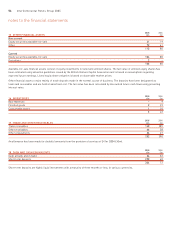

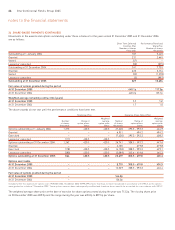

20 LOANS AND OTHER BORROWINGS £m £m £m £m £m £m

Secured bank loans 23638 24951

Unsecured bank loans – 374 374 12 1,104 1,116

Other unsecured borrowings –––18 3 21

Total borrowings 2 410 412 32 1,156 1,188

Secured bank loans

These mortgages are secured on the hotel properties to which they relate. The rates of interest and currencies of these loans vary.

Amounts falling due after one year include £15m (2004 £18m) repayable by instalment. Amounts shown as due within one year are the

mortgage repayments falling due within this period. The fair value of secured loans is calculated by discounting the expected future cash

flows at prevailing interest rates.

Unsecured bank loans

Unsecured bank loans are borrowings under the Group’s 2009 £1.1bn Syndicated Facility and its short-term bilateral loan facilities.

Amounts are classified as due within one year where the loan facility expires within this period. Covenants exist on these facilities and as

at the balance sheet date the Group was not in breach of these covenants. 2004 comparatives include £9m in respect of currency swaps

shown as unsecured bank loans under UK GAAP. The carrying value of these loans approximates fair value.

Other unsecured borrowings

In 2004, other unsecured borrowings relate to an £18m tranche of the 2010 €600m Guaranteed Notes 4.75% and £3m of other loan stock.

Most of the Guaranteed Notes were repurchased in December 2004, the remaining £18m was repurchased at par on 7 January 2005.

The other loan stock relates to the Soft Drinks business, was non interest bearing and was repaid during the year.

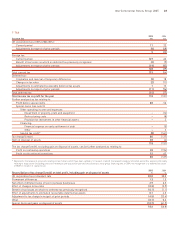

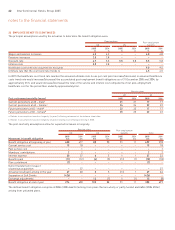

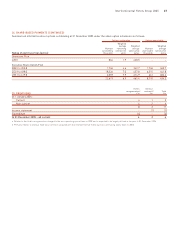

2005 2004

Utilised Unutilised Total Utilised Unutilised Total

£m £m £m £m £m £m

Facilities provided by banks

Committed 412 751 1,163 1,155 542 1,697

Uncommitted –141414 50 64

412 765 1,177 1,169 592 1,761

2005 2004

£m £m

Unutilised facilities expire:

within one year 39 90

after one year but before two years –500

after two years 726 2

765 592

InterContinental Hotels Group 2005 57