Holiday Inn 2005 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

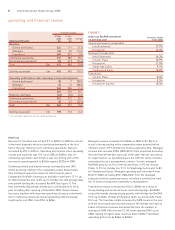

financial highlights

Transformation to a managed and franchised business nearing

completion. InterContinental Hotels Group now delivers more

stable earnings and has a clear growth focus.

Continuing operating profit* up 42% from £134m to £190m

with operating profit margin up 4 percentage points.

Group operating profit £317m, up £20m.

Adjusted†earnings per share from continuing business up 44%

from 17.3p to 24.9p. Group basic earnings per share up 77%

from 53.9p to 95.2p driven by gain on disposal of operations.

Final dividend up 7% from 10.00p to 10.70p per share:

total 2005 dividend up 7% from 14.30p§to 15.30p per share.

9.0% RevPAR#growth across the Group’s 3,600 hotels, mostly

rate driven with strongest trading in the Americas.

70,000 rooms signed in 2005, up 57% over 2004. Our contract

pipeline is the industry’s largest at 108,500 rooms, 20% of

existing room count. Room count up 3,300 to 537,500 rooms.

£500m special interim dividend to be paid during the second

quarter of 2006.

* Excludes Britvic and hotel assets sold or held for sale at 31 December 2005; operating profit before other operating

income and expenses.

†Excludes special items and gain on disposal of assets, net of related tax.

§Excludes special interim dividend paid in December 2004.

#Room revenue divided by the number of room nights available.

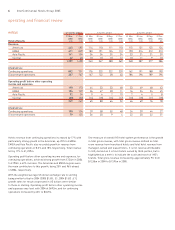

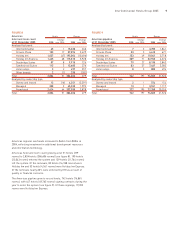

1OPERATING AND FINANCIAL REVIEW

18 DIRECTORS’ REPORT

20 CORPORATE GOVERNANCE

24 AUDIT COMMITTEE REPORT

25 REMUNERATION REPORT

34 FINANCIAL STATEMENTS

Group income statement

Group statement of recognised income and expense

Group cash flow statement

Group balance sheet

38 CORPORATE INFORMATION AND

ACCOUNTING POLICIES

42 NOTES TO THE FINANCIAL STATEMENTS

76 US GAAP INFORMATION

80 DIRECTORS’ RESPONSIBILITIES IN RELATION

TO THE GROUP FINANCIAL STATEMENTS

81 REPORT OF THE INDEPENDENT AUDITOR

82 COMPANY FINANCIAL STATEMENTS

83 NOTES TO THE COMPANY FINANCIAL

STATEMENTS

86 DIRECTORS’ RESPONSIBILITIES IN RELATION

TO THE COMPANY FINANCIAL STATEMENTS

87 REPORT OF THE INDEPENDENT AUDITOR

88 GLOSSARY

89 SHAREHOLDER PROFILE AND

FORWARD-LOOKING STATEMENTS

Front cover photo: Louise Wang, waitress, Plaza Bar, Crowne Plaza, Pudong, Shanghai