Holiday Inn 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

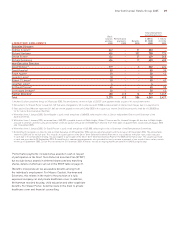

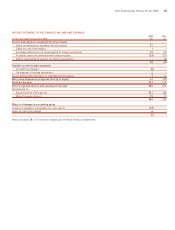

SHARE OPTIONS

Ordinary shares under option

Weighted

Options held at Granted Lapsed Exercised Options average

1.1.05 or date during the during the during the held at option Option

Directors of appointment year year year 31.12.05 price (p) price (p)

Andrew Cosslett

157,300 619.83

b 157,300

Total 157,300 – – 157,300 619.83

Richard Hartman 834,022 435.70

118,810 619.83

a 364,388 398.99

b 588,444 495.61

Total 834,022 118,810 – – 952,832 458.66

Stevan Porter 658,319 449.47

96,370 619.83

178,176 409.36

b 576,513 490.34

Total 658,319 96,370 – 178,176 576,513 490.34

Richard Solomons 831,360 426.49

100,550 619.83

357,545 375.24

b 574,365 492.24

Total 831,360 100,550 – 357,545 574,365 492.24

a Where the options are exercisable and the market price per share at 31 December 2005 was above the option price; and

b Where options are not yet exercisable. A performance condition has to be met before these options can be exercised.

Rolled over options, all of which are shown in ‘a’ above, became exercisable on the separation of Six Continents PLC in April 2003 and will lapse on various dates

up to October 2012. Rolled over options ceased to be subject to performance conditions on Separation. Executive share options granted in 2003 and 2004 are exercisable

between May 2006 and April 2014, subject to the achievement of the performance condition. Sharesave options granted in 2003 are exercisable between March 2007 and

March 2009. Share options under the IHG Executive Share Option Plan were granted on 4 April 2005 at an option price of 619.83p. These options are exercisable between

April 2008 and April 2015, subject to the achievement of the performance condition.

Option prices range from 308.48p to 619.83p per IHG PLC share. The closing market value share price on 30 December 2005 was 839.50p and the range during the year

was 634.98p to 839.50p per share.

The gain on exercise by Directors in aggregate was £1,658,109 in the year ended 31 December 2005 (nil in the year ended 31 December 2004). The market value share

prices on the exercise of options by Stevan Porter and Richard Solomons were 728p per share and 720.50p per share respectively.

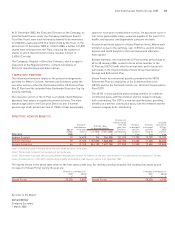

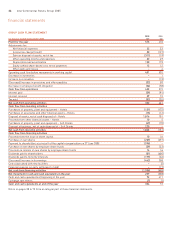

6 DIRECTORS’ SHAREHOLDINGS

31 December 2005 1 January 20051

InterContinental Hotels Group PLC InterContinental Hotels Group PLC

Executive Directors ordinary shares of 10p4ordinary shares of 112p2,4

Andrew Cosslett 7,332 –

Richard Hartman 70,117 45,247

Stevan Porter 64,589 88,077

Richard Solomons 60,339 16,031

Non-Executive Directors

David Kappler 1,908 2,602

Ralph Kugler 654 892

Jennifer Laing ––

Robert C Larson 7,857310,7143

Jonathan Linen ––

Sir David Prosser 3,273 4,464

Sir Howard Stringer 5,548 7,566

David Webster 31,823 13,395

1 Or date of appointment, if later.

2 These share interests were in InterContinental Hotels Group PLC 112p ordinary shares prior to the capital reorganisation effective from 27 June 2005.

For every 15 existing InterContinental Hotels Group PLC shares held on 24 June 2005, shareholders received 11 new ordinary shares of 10p each and £24.75 in cash.

3 Held in the form of American Depositary Receipts.

4 These shareholdings are all beneficial interests and include shares held by Directors’ spouses and other connected persons. None of the Directors has a beneficial

interest in the shares of any subsidiary.

remuneration report

32 InterContinental Hotels Group 2005