Holiday Inn 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate information

The consolidated financial statements of InterContinental Hotels

Group PLC (IHG) for the year ended 31 December 2005 were

authorised for issue in accordance with a resolution of the

Directors on 1 March 2006. InterContinental Hotels Group PLC

(the Company) is incorporated in Great Britain and registered in

England and Wales.

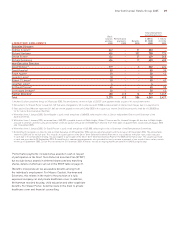

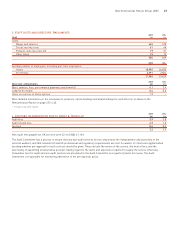

Summary of significant accounting policies

BASIS OF PREPARATION

The financial statements have been prepared on an historic cost

basis, except for derivative financial instruments and available-for-

sale financial assets that have been measured at fair value. The

consolidated financial statements are presented in sterling and all

values are rounded to the nearest million (£m) except where

otherwise indicated.

STATEMENT OF COMPLIANCE

The consolidated financial statements of IHG have been prepared

in accordance with International Financial Reporting Standards

(IFRS) as adopted by the European Union (EU) and as applied in

accordance with the provisions of the Companies Act 1985. As

permitted, the Group has also early adopted the amendment to

International Accounting Standard (IAS) 19 ‘Employee Benefits’

published in December 2004.

IFRS EXEMPTIONS

IFRS 1 ‘First-time Adoption of International Financial Reporting

Standards’ has been applied in preparing this financial information.

The Group has taken the following exemptions available under

IFRS 1:

a) Not to restate the comparative information disclosed

in the 2005 financial statements in accordance with IAS 32

‘Financial Instruments: Disclosure and Presentation’ and

IAS 39 ‘Financial Instruments: Recognition and Measurement’.

b) Not to restate business combinations before 1 January 2004.

c) To recognise all actuarial gains and losses on pensions

and other post-employment benefits directly in equity at

1 January 2004.

d) To retain UK GAAP carrying values of property, plant and

equipment, including revaluations, as deemed cost at

transition.

e) Not to recognise separately cumulative foreign exchange

movements up to 1 January 2004.

f) To apply IFRS 2 ‘Share-based Payments’ to grants of equity

instruments after 7 November 2002 that had not vested at

1 January 2005.

The disclosures required by IFRS 1 are given in note 33.

The principle accounting policies of the Group are set out below.

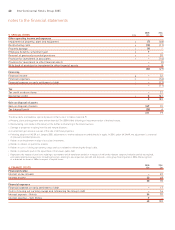

BASIS OF CONSOLIDATION

The Group financial statements comprise the financial statements

of the parent company and entities controlled by the Company. All

inter-company balances and transactions have been eliminated.

The results of those businesses acquired or disposed of are

consolidated for the period during which they were under the

Group’s control.

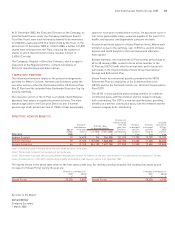

Shareholder approval was given on 1 June 2005 to recommended

proposals for the return of approximately £1bn to shareholders by

way of a capital reorganisation (by means of a scheme of

arrangement under Section 425 of the Companies Act 1985). Under

the arrangement, shareholders received 11 new ordinary shares

and £24.75 cash in exchange for every 15 existing ordinary shares

held on 24 June 2005. The overall effect of the transaction was that

of a share repurchase at fair value, therefore no adjustment has

been made to comparative earnings per share data (see note 9).

The capital reorganisation of InterContinental Hotels Group PLC

to New InterContinental Hotels Group PLC has been accounted

for in accordance with the principles of merger accounting as

applicable to group reorganisations. The consolidated financial

statements are therefore presented as if New InterContinental

Hotels Group PLC had been the parent company of the Group

throughout the periods presented. Following this capital

reorganisation, InterContinental Hotels Group PLC changed

its name to InterContinental Hotels PLC and re-registered as

a private limited company, InterContinental Hotels Limited;

New InterContinental Hotels Group PLC changed its name

to InterContinental Hotels Group PLC.

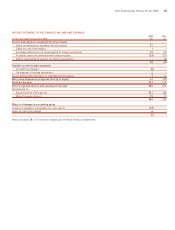

FOREIGN CURRENCIES

Transactions in foreign currencies are translated to the functional

currency at the exchange rates ruling on the dates of the

transactions. All foreign exchange differences arising on translation

are recognised in the income statement except on foreign currency

borrowings that provide a hedge against a net investment in

a foreign operation. These are taken directly to the currency

translation reserve until the disposal of the net investment, at

which time they are recycled against the gain or loss on disposal.

The assets and liabilities of foreign operations, including goodwill,

are translated into sterling at the relevant rates of exchange ruling

at the balance sheet date. The revenues and expenses of foreign

operations are translated into sterling at weighted average rates

of exchange for the period. The exchange differences arising on the

retranslation are taken directly to the currency translation reserve.

On disposal of a foreign operation, the cumulative amount recognised

in the currency translation reserve relating to that particular

foreign operation is recycled against the gain or loss on disposal.

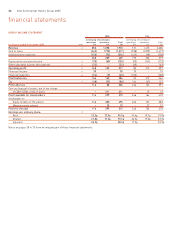

corporate information and accounting policies

38 InterContinental Hotels Group 2005