Holiday Inn 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

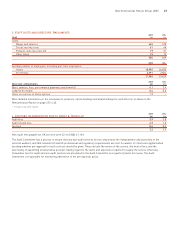

Until 1 January 2005, investments were recorded in accordance

with UK GAAP at cost less any provision for impairment.

Available-for-sale financial assets are tested for impairment at

each balance sheet date. If impaired, the difference between

carrying value and fair value is transferred from equity to the

income statement to the extent that there is sufficient surplus

in equity; any excess goes directly to the income statement.

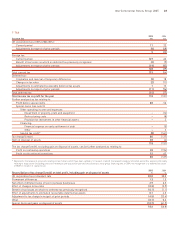

INVENTORIES

Inventories are stated at the lower of cost and net realisable value.

TRADE RECEIVABLES

Trade receivables are recorded at their original amount less an

allowance for any doubtful amounts. An allowance is made when

collection of the full amount is no longer considered probable.

CASH AND CASH EQUIVALENTS

Cash comprises cash in hand and demand deposits.

Cash equivalents are short-term highly liquid investments with a

maturity of three months or less that are readily convertible to known

amounts of cash and subject to insignificant risk of changes in value.

ASSETS HELD FOR SALE

Assets and liabilities are classified as held for sale when their

carrying amount will be recovered principally through a sale

transaction rather than continuing use and a sale is highly probable.

Assets designated as held for sale are held at the lower of carrying

amount at designation and sales value less cost to sell.

Depreciation is not charged against property, plant and equipment

classified as held for sale.

The Group has taken advantage of the transitional provisions of IFRS 5

‘Non-current Assets Held for Sale and Discontinued Operations’ and

applied the standard for the period beginning 1 January 2004.

TRADE PAYABLES

Trade payables are non interest bearing and are stated at their

nominal value.

LOYALTY PROGRAMME

The hotel loyalty programme, Priority Club Rewards, enables

members to earn points, funded through hotel assessments, during

each stay at an InterContinental Hotels Group hotel and redeem the

points at a later date for free accommodation or other benefits. The

future redemption liability is included in trade and other payables

and provisions and other payables and is estimated using actuarial

methods to give eventual redemption rates and points values.

SELF INSURANCE

The Group is self insured for various levels of general liability,

workers’ compensation and employee medical and dental coverage.

Insurance reserves include projected settlements for known and

incurred but not reported claims. Projected settlements are

estimated based on historical trends and actuarial data.

PROVISIONS

Provisions are recognised when the Group has a present obligation

as a result of a past event, it is probable that a payment will be made

and a reliable estimate of the amount can be made. If the effect of

the time value of money is material, the provision is discounted.

BANK AND OTHER BORROWINGS

Bank and other borrowings are held at amortised cost. Finance

charges, including issue costs, are charged to the income

statement using an effective interest rate method.

Borrowings are classified as non-current when the repayment date

is more than 12 months from the balance sheet date or where they

are drawn on a facility with more than 12 months to expiry.

PENSIONS

Defined contribution plans Payments to defined contribution

schemes are charged to the income statement as they fall due.

Defined benefit plans Plan assets are measured at fair value and

plan liabilities are measured on an actuarial basis, using the

projected unit credit method and discounting at an interest rate

equivalent to the current rate of return on a high quality corporate

bond of equivalent currency and term to the plan liabilities.

The service cost of providing pension benefits to employees for the

year is charged to the income statement. The cost of making

improvements to pensions is recognised in the income statement

on a straight line basis over the period during which any increase

in benefits vests. To the extent that improvements in benefits vest

immediately, the cost is recognised immediately as an expense.

Actuarial gains and losses may result from: differences between

the expected return and the actual return on plan assets;

differences between the actuarial assumptions underlying the plan

liabilities and actual experience during the year; or changes in the

actuarial assumptions used in the valuation of the plan liabilities.

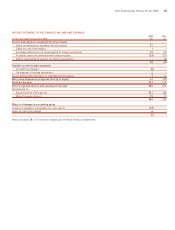

Actuarial gains and losses, and taxation thereon, are recognised

in the Group statement of recognised income and expense.

Actuarial valuations are normally carried out every three years.

DEFERRED TAX

Deferred tax assets and liabilities are recognised in respect of all

temporary differences between the tax base and carrying value of

assets and liabilities. Those temporary differences recognised include

accelerated capital allowances, unrelieved tax losses, unremitted

profits from overseas where the Group does not control remittance,

gains rolled over into replacement assets, gains on previously

revalued properties and other short-term temporary differences.

Deferred tax assets are recognised to the extent that it is regarded

as probable that the deductible temporary differences can be

utilised. The recoverability of all deferred tax assets is reassessed

at each balance sheet date.

Deferred tax is calculated at the tax rates that are expected to apply

in the periods in which the asset or liability will be settled, based

on rates enacted or substantively enacted at the balance sheet date.

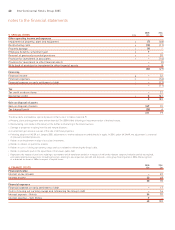

corporate information and accounting policies

40 InterContinental Hotels Group 2005