Hertz 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

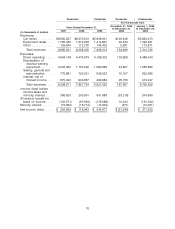

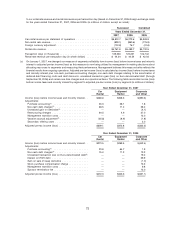

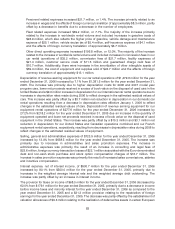

The following table reconciles historical net income (loss) (i) to Corporate EBITDA on an actual basis for the Successor years

ended December 31, 2007 and 2006 and the Successor period ended December 31, 2005 and (ii) to Corporate EBITDA on a

pro forma basis, as it relates to car rental fleet interest and non-cash amortization of debt costs, for the combined year ended

December 31, 2005 and the Predecessor period ended December 20, 2005 (in millions of dollars):

Successor Combined Successor Predecessor

For the Periods From

December 21, January 1,

2005 to 2005 to

Years ended December 31, December 31, December 20,

2007 2006 2005 2005 2005

Net income (loss)(1) ................ $ 264.5 $ 115.9 $ 350.0 $(21.3) $ 371.3

Depreciation and amortization(2) ...... 2,243.1 2,016.1 1,790.4 51.4 1,739.0

Interest, net of interest income(1)(3) ..... 875.4 900.7 500.0 25.8 474.2

Provision (benefit) for taxes on income . . . 102.6 68.0 179.1 (12.2) 191.3

EBITDA ....................... 3,485.6 3,100.7 2,819.5 43.7 2,775.8

Adjustments:

Car rental fleet interest(4) ........... (427.8) (400.0) (406.9) (11.7) (395.2)

Car rental fleet depreciation(5) ........ (1,695.4) (1,479.6) (1,381.5) (37.4) (1,344.1)

Non-cash expenses and charges(6) .... 102.2 130.6 106.2 2.5 103.7

Extraordinary, unusual or non-recurring

gains or losses(7) .............. 76.9 23.8 4.0 — 4.0

Sponsors’ fees ................. — 3.2 — — —

Corporate EBITDA(8) ............... $1,541.5 $ 1,378.7 $ 1,141.3 $ (2.9) $ 1,144.2

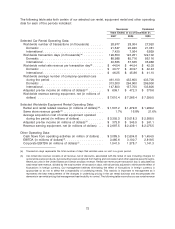

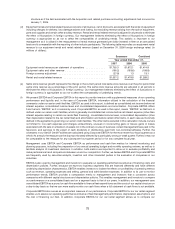

(1) For the year ended December 31, 2007, includes corporate audit and legal fees of $0.4 million, secondary offering costs

of $2.0 million and $0.4 million of interest income attributable to Hertz Holdings. For the year ended December 31, 2006,

includes corporate audit fees of $0.1 million and $40.0 million ($26.0 million net of tax), of interest expense attributable

to Hertz Holdings. For the year ended December 31, 2007 and 2006, the Successor period ended December 31, 2005

and the Predecessor period ended December 20, 2005, includes corporate minority interest of $19.7 million,

$16.7 million, $0.3 million and $12.3 million, respectively.

(2) For the years ended December 31, 2007 and 2006, the Successor period ended December 31, 2005 and the

Predecessor period ended December 20, 2005, depreciation and amortization was $1,856.6 million, $1,659.8 million,

$42.6 million and $1,485.9 million, respectively, in our car rental segment and $380.6 million, $350.3 million, $8.6 million

and $248.2 million, respectively, in our equipment rental segment.

(3) For the years ended December 31, 2007 and 2006, the Successor period ended December 31, 2005 and the

Predecessor period ended December 20, 2005, interest, net of interest income was $436.8 million, $424.1 million,

$15.8 million, and $349.2 million, respectively, in our car rental segment and $146.3 million, $140.0 million, $3.4 million

and $86.4 million, respectively, in our equipment rental segment.

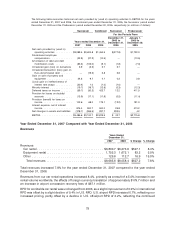

(4) As defined in the credit agreements governing our senior credit facilities, Corporate EBITDA includes a reduction for

certain car rental fleet related interest. For the Predecessor period presented, car rental fleet interest has been

calculated on a pro forma basis to give effect to the U.S. and international fleet debt financings entered into as part of the

Transactions as if they had occurred on January 1, 2005. For the Successor periods presented, car rental fleet interest is

based on actual results.

(5) As defined in the credit agreements governing our senior credit facilities, Corporate EBITDA includes a reduction for car

rental fleet depreciation. For all periods presented, car rental fleet depreciation does not vary from the historical

amounts.

(6) For the years ended December 31, 2007 and 2006, the Successor period ended December 31, 2005 and the

Predecessor period ended December 20, 2005, non-cash expenses and charges were $64.2 million, $73.0 million,

$2.5 million and $92.4 million, respectively, in our car rental segment and $2.7 million, $(0.4) million, $0.0 million and

$1.0 million, respectively, in our equipment rental segment.

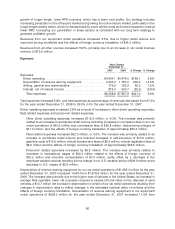

As defined in the credit agreements governing our senior credit facilities, Corporate EBITDA excludes the impact of

certain non-cash expenses and charges. For the Successor periods presented, non-cash amortization of debt costs

included in car rental fleet interest is based on actual results. For the Predecessor period ended December 20, 2005,

non-cash amortization of debt costs included in car rental fleet interest has been calculated on a pro forma basis to give

77