Hertz 2007 Annual Report Download - page 87

Download and view the complete annual report

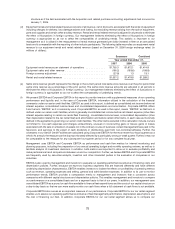

Please find page 87 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.requirements are based on actuarial evaluations of historical accident claim experience and trends, as

well as future projections of ultimate losses, expenses, premiums and administrative costs. The

adequacy of the liability is regularly monitored based on evolving accident claim history. If our estimates

change or if actual results differ from these assumptions, the amount of the recorded liability is adjusted

to reflect these results.

Pensions

Our employee pension costs and obligations are dependent on our assumptions used by actuaries in

calculating such amounts. These assumptions include discount rates, salary growth, long-term return

on plan assets, retirement rates, mortality rates and other factors. Actual results that differ from our

assumptions are accumulated and amortized over future periods and, therefore, generally affect our

recognized expense in such future periods. While we believe that the assumptions used are appropriate,

significant differences in actual experience or significant changes in assumptions would affect our

pension costs and obligations.

Goodwill and Other Intangible Assets

We review goodwill for impairment whenever events or changes in circumstances indicate that the

carrying amount of the goodwill may not be recoverable, and also review goodwill annually in

accordance with SFAS No. 142, ‘‘Goodwill and Other Intangible Assets.’’ We performed an annual

review in the second quarter of 2007, consistent with past years, and no impairment was determined to

exist. Subsequent to performing our annual impairment review, we changed the date for performing

these tests to the fourth quarter based on financial information available through October 1, 2007. We

believe this change in accounting principle is preferable because the new date more closely aligns with

our annual budgeting process and allows for a better estimation of the future cash flows used in the

discounted cash flow model that we use to test for impairment. The change in accounting principle has

no effect on our consolidated financial statements presented herein. We conducted the impairment

review during the fourth quarter of 2007 and no impairment was determined to exist. Under SFAS

No. 142, goodwill impairment is deemed to exist if the carrying value of goodwill exceeds its fair value. In

addition, SFAS No. 142 requires that goodwill be tested at least annually using a two-step process. The

first step is to identify any potential impairment by comparing the carrying value of the reporting unit to its

fair value. If a potential impairment is identified, the second step is to compare the implied fair value of

goodwill with its carrying amount to measure the impairment loss. We estimate the fair value of our

reporting units using a discounted cash flow methodology. A significant decline in the projected cash

flows used to determine fair value could result in a goodwill impairment charge.

The Acquisition was recorded by allocating the cost of the assets acquired, including intangible assets

and liabilities assumed, based on their estimated fair values at the Acquisition date. Consequently, as a

result of the Acquisition, we have recognized significant intangible assets. In accordance with SFAS

No. 142, we reevaluate the estimated useful lives of our intangible assets annually or as circumstances

change. Those intangible assets considered to have indefinite useful lives are evaluated for impairment

on an annual basis, by comparing the fair value of the intangible asset to its carrying value. In addition,

whenever events or changes in circumstances indicate that the carrying value of intangible assets might

not be recoverable, we will perform an impairment review. We estimate the fair value of our intangible

assets using a discounted cash flow methodology. Intangible assets with finite useful lives are amortized

over their respective estimated useful lives and reviewed for impairment in accordance with SFAS

No. 144, ‘‘Accounting for Impairment or Disposal of Long-Lived Assets.’’

Our estimates are based upon historical trends, management’s knowledge and experience and overall

economic factors. While we believe our estimates are reasonable, different assumptions regarding items

such as future cash flows and volatility in the markets we serve could affect our evaluations and result in

an impairment charge to the carrying amount of our goodwill and our intangible assets.

67