Hertz 2007 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

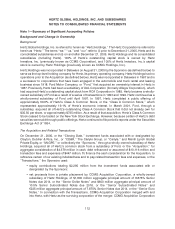

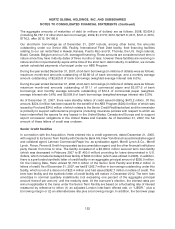

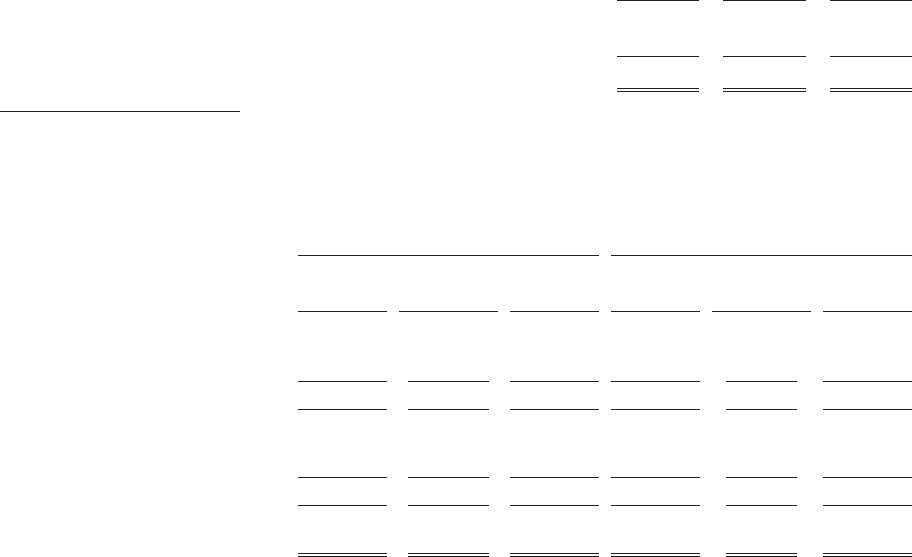

The following summarizes the changes in our goodwill, by segment (in thousands of dollars):

Equipment

Car Rental Rental Total

Balance as of December 31, 2006 ....................... $336,579 $628,114 $964,693

Changes(1) ........................................ (18,445) 13,745 (4,700)

Balance as of December 31, 2007 ....................... $318,134 $641,859 $959,993

(1) Consists of changes primarily resulting from the adoption of FIN 48 and prior period adjustments to deferred taxes recorded

as of the acquisition date (see Note 7—Taxes on Income), partly offset by the translation of foreign currencies at different

exchange rates from the beginning of the period to the end of the period.

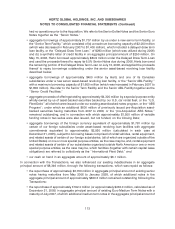

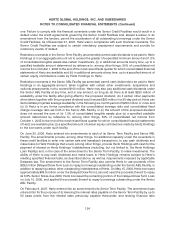

Other intangible assets, net, consisted of the following major classes (in thousands of dollars):

December 31, 2007 December 31, 2006

Gross Net Gross Net

Carrying Accumulated Carrying Carrying Accumulated Carrying

Amount Amortization Value Amount Amortization Value

Amortizable intangible assets:

Customer-related ........... $ 617,012 $(124,647) $ 492,365 $ 611,783 $(63,046) $ 548,737

Other .................. 5,898 (1,505) 4,393 1,270 (512) 758

Total .................. 622,910 (126,152) 496,758 613,053 (63,558) 549,495

Indefinite-lived intangible assets:

Trade name .............. 2,624,000 — 2,624,000 2,624,000 — 2,624,000

Other .................. 2,709 — 2,709 — — —

Total .................. 2,626,709 — 2,626,709 2,624,000 — 2,624,000

Total other intangible

assets, net .......... $3,249,619 $(126,152) $3,123,467 $3,237,053 $(63,558) $3,173,495

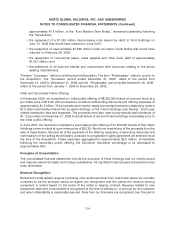

Amortization of other intangible assets for the years ended December 31, 2007 and 2006, the Successor

period ended December 31, 2005 and the Predecessor period ended December 20, 2005, was

$62.6 million, $61.6 million, $2.1 million and $0.7 million, respectively. Based on our amortizable

intangible assets as of December 31, 2007, we expect amortization expense to range from $61.3 million

to $63.6 million for each of the next five fiscal years.

During the year ended December 31, 2007, we added 48 locations by acquiring former franchisees in

our domestic and international car rental operations. Total cash paid for intangible assets during the year

ended December 31, 2007 was $12.2 million. We recognized $9.9 million in amortizable intangible

assets and $2.3 million in indefinite-lived intangible assets during the year ended December 31, 2007.

Each of these transactions has been accounted for using the purchase method of accounting, and

operating results of the acquirees from the dates of acquisition are included in our consolidated

statements of operations. These acquisitions are not material individually or collectively to the amounts

presented for the year ended December 31, 2007. Additionally, we purchased other indefinite-lived

intangible assets of $0.4 million, which were not part of any reacquired franchisee.

120