Hertz 2007 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234

|

|

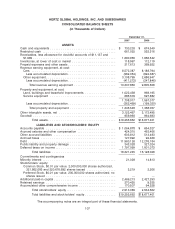

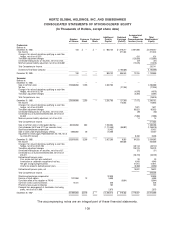

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands of Dollars)

Successor Predecessor

For the periods from

December 21, January 1,

2005 to 2005 to

Years ended December 31, December 31, December 20,

2007 2006 2005 2005

Cash flows from operating activities:

Net income (loss) ......................... $ 264,559 $ 115,943 $ (21,346) $ 371,323

Non-cash expenses:

Depreciation of revenue earning equipment ........ 2,003,360 1,757,202 43,827 1,555,862

Depreciation of property and equipment .......... 177,113 197,230 5,511 182,363

Amortization of other intangible assets ........... 62,594 61,614 2,075 749

Amortization of deferred financing costs .......... 48,409 66,127 1,304 5,299

Debt modification costs .................... 16,177 — — —

Amortization of debt discount ................ 20,747 38,872 456 1,999

Stock-based employee compensation ........... 32,939 27,179 — 10,496

Loss on revaluation of foreign denominated debt ..... — 19,233 (2,826) —

Unrealized (gain) loss on derivatives ............ (3,925) 2,454 (2,696) —

Loss (gain) on ineffectiveness of interest rate swaps . . . 20,424 (1,034) 1,034 —

Provision for losses on doubtful accounts ......... 13,874 17,132 462 11,447

Minority interest ......................... 19,690 16,714 371 12,251

Deferred taxes on income ................... 59,743 30,354 (12,243) (411,461)

Gain on sale of property and equipment .......... (24,807) (9,743) (282) (3,807)

Changes in assets and liabilities, net of effects of

acquisition:

Receivables ........................... 84,541 229,663 (121,497) (547,302)

Due from affiliates ....................... — — 107,791 83,868

Inventories, prepaid expenses and other assets ..... 709 (18,548) (164,883) (134,052)

Accounts payable ........................ 304,170 (4,708) (58,565) (32,676)

Accrued liabilities ........................ (20,299) 86,308 (52,157) 51,364

Accrued taxes .......................... 10,875 (3,789) 1,881 572,452

Public liability and property damage ............ (1,405) (23,381) (6,020) 2,146

Net cash provided by (used in) operating activities . . $ 3,089,488 $ 2,604,822 $ (277,803) $ 1,732,321

The accompanying notes are an integral part of these financial statements.

110