Hertz 2007 Annual Report Download - page 105

Download and view the complete annual report

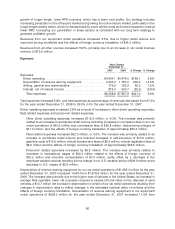

Please find page 105 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our primary use of cash in investing activities is for the acquisition of revenue earning equipment, which

consists of cars and equipment. Net cash used in investing activities during the year ended

December 31, 2007 was $2,343.6 million, an increase of $65.4 million from the year ended December 31,

2006. The increase is primarily due to a decrease in proceeds from the disposal of revenue earning

equipment, partly offset by a decrease in the year-over-year net change in restricted cash and a

decrease in revenue earning equipment expenditures. For the year ended December 31, 2007, our

expenditures for revenue earning equipment were $11,342.1 million, partially offset by proceeds from

the disposal of such equipment of $9,214.3 million. These assets are purchased by us in accordance

with the terms of programs negotiated with the car and equipment manufacturers.

For the year ended December 31, 2007, our expenditures for property and non-revenue earning

equipment were $196.0 million. For the year ended December 31, 2007, we experienced a level of net

expenditures for revenue earning equipment and property and equipment slightly higher than our net

expenditures for the year ended December 31, 2006. This increase was due to a year-over-year

decrease in disposal proceeds relating to revenue earning equipment, partly offset by decreases in

year-over-year expenditures for both revenue earning equipment and property and equipment. For

2008, we expect the level of net expenditures for revenue earning equipment, property and non-revenue

earning equipment to be similar to that of 2007. See ‘‘—Capital Expenditures’’ below.

Our car rental and equipment rental operations are seasonal businesses with decreased levels of

business in the winter months and heightened activity during the spring and summer. This is particularly

true of our airport car rental operations and our equipment rental operations. To accommodate

increased demand, we maintain a larger fleet by holding vehicles and equipment and purchasing

additional fleet which increases our financing requirements in the second and third quarters of the year.

These seasonal financing needs are funded by increasing the utilization of our bank credit facilities and

the variable funding notes portion of our U.S. Fleet Debt facilities and, in past years, our commercial

paper program. As business demand moderates during the winter, we reduce our fleet accordingly and

dispose of vehicles and equipment. The disposal proceeds are used to reduce debt.

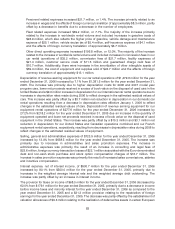

We are highly leveraged and a substantial portion of our liquidity needs arise from debt service on

indebtedness incurred in connection with the Transactions and from the funding of our costs of

operations, working capital and capital expenditures.

As of December 31, 2007, we had approximately $11,960.1 million of total indebtedness outstanding.

Cash paid for interest during the year ended December 31, 2007, was $814.1 million, net of amounts

capitalized.

We rely significantly on asset-backed financing to purchase cars for our domestic and international car

rental fleets. For further information concerning our asset-backed financing programs, see ‘‘—Fleet

Financing’’ below. For a discussion of risks related to our reliance on asset-backed financing to

purchase cars, see ‘‘Item 1A—Risk Factors—Risks Related to Our Business—Our reliance on asset-

backed financing to purchase cars subjects us to a number of risks, many of which are beyond our

control.’’

Also, substantially all of our revenue earning equipment and certain related assets are owned by special

purpose entities, or are subject to liens in favor of our lenders under the Senior ABL Facility, the ABS

Program, the International Fleet Debt facilities or the fleet financing facility relating to our car rental fleet in

Hawaii, Kansas, Puerto Rico and St. Thomas, the U.S. Virgin Islands, Brazil, Canada, Belgium and our

U.K. leveraged financing, all as described in more detail below. Substantially all our other assets in the

United States are also subject to liens in favor of our lenders under the Senior Credit Facilities, and

substantially all of our other assets outside the United States are (with certain limited exceptions) subject

to liens in favor of our lenders under the International Fleet Debt facilities or (in the case of our Canadian

HERC business) the Senior ABL Facility. None of such assets will be available to satisfy the claims of our

general creditors.

85