Hertz 2007 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

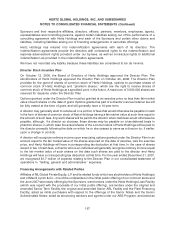

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2006, the balance reflected in ‘‘Accumulated other comprehensive income,’’ net of tax, was a loss of

$45.6 million, and a gain of $3.5 million, respectively. As of December 31, 2006, the fair value of the HVF

Swaps was an asset of $50.6 million, which is reflected in our consolidated balance sheet in ‘‘Prepaid

expenses and other assets.’’ As of December 31, 2007, the fair value of our HVF Swaps was a liability of

$50.2 million, which is reflected in our consolidated balance sheet in ‘‘Other accrued liabilities.’’

In connection with the entrance into the HVF swaps, Hertz entered into seven differential interest rate

swap agreements, or the ‘‘differential swaps.’’ These differential swaps were required to be put in place

to protect the counterparties to the HVF swaps in the event of an ‘‘amortization event’’ under the asset-

backed notes agreements. In the event of an amortization event, the amount by which the principal

balance on the floating rate portion of the U.S. Fleet Debt is reduced, exclusive of the originally

scheduled amortization, becomes the notional amount of the differential swaps, and is transferred to

Hertz. There was no payment associated with these differential swaps and their notional amounts are

and will continue to be zero unless 1) there is an amortization event, which causes the amortization of the

loan balance, or 2) the debt is prepaid.

An event of bankruptcy (as defined in the indentures governing the U.S. Fleet Debt) with respect to MBIA

or Ambac would constitute an amortization event under the portion of the U.S. Fleet Debt facilities

guaranteed by the affected insurer. In that event we would also be required to apply a proportional

amount, or substantially all in the case of insolvency of both insurers, of all rental payments by Hertz to its

special purpose leasing subsidiary and all car disposal proceeds under the applicable facility, or under

substantially all U.S. Fleet Debt facilities in the case of insolvency of both insurers, to pay down the

amounts owed under the facility or facilities instead of applying those proceeds to purchase additional

cars and/or for working capital purposes. An insurer event of bankruptcy could have a material adverse

effect on our liquidity if we were unable to negotiate mutually acceptable new terms with our U.S. Fleet

Debt lenders or if alternate funding were not available to us.

In connection with our Euro Medium Term Notes that were not tendered to us in connection with the

Acquisition, we entered into an interest rate swap agreement on December 21, 2005, effective

January 16, 2006, maturing on July 16, 2007. The purpose of this interest rate swap is to lock in the

interest cash outflows at a fixed rate of 4.1% on the variable rate Euro Medium Term Notes. As the critical

terms of the swap and remaining portion of the Euro Medium Term Notes match, the swap qualified for

cash flow hedge accounting and the shortcut method of assessing effectiveness, in accordance with

SFAS 133. Therefore, the fair value of the swap was carried on the balance sheet, with offsetting gains or

losses recorded in other comprehensive income. On June 30, 2007, the remaining notes outstanding

and related interest rate swap agreements pursuant to the Euro Medium Term Note Program were repaid

in full and expired, respectively.

In May 2006, in connection with the forecasted issuance of the permanent take-out international asset-

based facilities, HIL purchased two swaptions for e3.3 million, to protect itself from interest rate

increases. These swaptions gave HIL the right, but not the obligation, to enter into three year interest rate

swaps, based on a total notional amount of e600 million at an interest rate of 4.155%. The swaptions

were renewed twice in 2007, prior to their scheduled expiration dates of March 15, 2007 and

September 5, 2007, at a total cost of e2.7 million, and now expire on June 5, 2008. As of December 31,

2007 and December 31, 2006, the fair value of the swaptions was e6.2 million (or $9.2 million) and

e1.3 million (or $1.7 million), respectively, which is reflected in our consolidated balance sheet in

‘‘Prepaid expenses and other assets.’’ During the years ended December 31, 2007 and 2006, the fair

value adjustment related to these swaptions was a gain of $3.9 million and a loss of $2.5 million,

respectively, which was recorded in our consolidated statement of operations in ‘‘Selling, general and

administrative’’ expenses.

161