Hertz 2007 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• The International Fleet Debt facilities had the foreign currency equivalent of approximately

$885.6 million of remaining capacity and $223.3 million available under the borrowing base

limitation.

• The Fleet Financing Facility had approximately $103.0 million of remaining capacity and

$4.8 million available under the borrowing base limitation.

• The Brazilian Fleet Financing Facility had the foreign currency equivalent of approximately

$10.3 million of remaining capacity and $10.3 million available under the borrowing base

limitation.

• The Canadian Fleet Financing Facility had the foreign currency equivalent of approximately

$236.7 million of remaining capacity and no amounts available under the borrowing base

limitation.

• The U.K. Leveraged Financing Facility had the foreign currency equivalent of approximately

$48.5 million of remaining capacity and no amounts available under the borrowing base

limitation.

As of December 31, 2007, substantially all of our assets were pledged under one or more of the facilities

noted above.

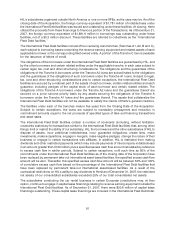

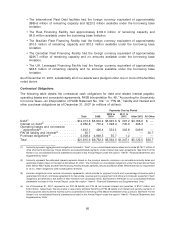

Contractual Obligations

The following table details the contractual cash obligations for debt and related interest payable,

operating leases and concession agreements, FASB Interpretation No. 48, ‘‘Accounting for Uncertainty

in Income Taxes—an Interpretation of FASB Statement No. 109,’’ or ‘‘FIN 48,’’ liability and interest and

other purchase obligations as of December 31, 2007 (in millions of dollars):

Payments Due by Period

2009 to 2011 to

Total 2008 2010 2012 After 2012 All Other

Debt(1) ......................... $12,013.6 $3,604.2 $3,945.6 $ 297.2 $4,166.6 $ —

Interest on debt(2) ................. 2,952.8 772.2 1,028.4 745.9 406.3 —

Operating leases and concession

agreements(3) .................. 1,812.1 426.4 533.3 302.8 549.6 —

FIN 48 liability and interest(4) ......... 30.7 — — — — 30.7

Purchase obligations(5) ............. 5,006.4 4,949.5 55.7 1.2 — —

Total ........................... $21,815.6 $9,752.3 $5,563.0 $1,347.1 $5,122.5 $30.7

(1) Amounts represent aggregate debt obligations included in ‘‘Debt’’ in our consolidated balance sheet and include $2,767.7 million of

other short-term borrowings. These amounts exclude estimated payments under interest rate swap agreements. See Note 3 to the

Notes to our consolidated financial statements included in this Annual Report under the caption ‘‘Item 8—Financial Statements and

Supplementary Data.’’

(2) Amounts represent the estimated interest payments based on the principal amounts, minimum non-cancelable maturity dates and

applicable interest rates on the debt at December 31, 2007. The minimum non-cancelable obligations under the International Fleet

Debt, Senior ABL Facility and the Fleet Financing Facility matures between January and March 2008. While there was no requirement

to do so, these obligations were subsequently renewed.

(3) Includes obligations under various concession agreements, which provide for payment of rents and a percentage of revenue with a

guaranteed minimum, and lease agreements for real estate, revenue earning equipment and office and computer equipment. Such

obligations are reflected to the extent of their minimum non-cancelable terms. See Note 8 to the Notes to our consolidated financial

statements included in this Annual Report under the caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

(4) As of December 31, 2007, represents our FIN 48 liability and FIN 48 net accrued interest and penalties of $18.7 million and

$12.0 million, respectively. We are unable to reasonably estimate the timing of FIN 48 liability and interest and penalty payments in

individual years beyond twelve months due to uncertainties in the timing of the effective settlement of tax positions. See Note 7 to the

Notes to our consolidated financial statements included in this Annual Report under the caption ‘‘Item 8—Financial Statements and

Supplementary Data.’’

95