Hertz 2007 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

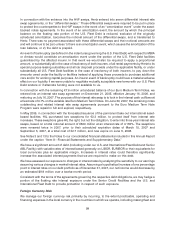

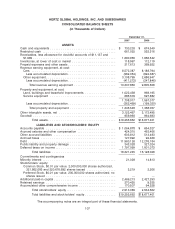

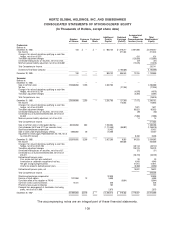

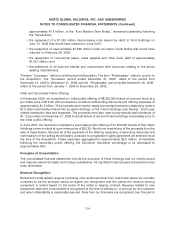

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In Thousands of Dollars, except share data)

Accumulated

Additional Retained Other Total

Number Common Preferred Paid-In Earnings Comprehensive Stockholders’

of Shares Stock Stock Capital (Deficit) Income (Loss) Equity

Predecessor

Balance at:

December 31, 2004 . . . . . . . . . . . . . . . ........ 100 $ — $ — $ 983,132 $ 1,479,217 $ 207,898 $ 2,670,247

Net income . . . . . . . . . . . . . . ............ 371,323 371,323

Change in fair value of derivatives qualifying as cash flow

hedges, net of tax of $281 . . . . . . ........... 424 424

Translation adjustment changes . .............. (123,893) (123,893)

Unrealized holding losses on securities, net of tax of $5 . . . (37) (37)

Minimum pension liability adjustment, net of tax of $5,891 . (12,076) (12,076)

Total Comprehensive Income . . . . . . ........... 235,741

Dividend to Ford Motor Company . . . . . ......... (1,185,000) (1,185,000)

December 20, 2005 . . . . . . . . . . . . . . . ........ 100 — — 983,132 665,540 72,316 1,720,988

Successor

Balance at:

December 21, 2005 . . . . . . . . . . . . . . . ........ — — — — — — —

Sale of common stock . . . . . . . . . . . . ........ 229,500,000 2,295 2,292,705 2,295,000

Net loss . . . . . . . . . . . . . . .............. (21,346) (21,346)

Change in fair value of derivatives qualifying as cash flow

hedges, net of tax of $2,704 . . . . . . . ......... (4,078) (4,078)

Translation adjustment changes . .............. (3,394) (3,394)

Total Comprehensive Loss . . . . . . . . . . ........ (28,818)

December 31, 2005 . . . . . . . . . . . . . . . ........ 229,500,000 2,295 — 2,292,705 (21,346) (7,472) 2,266,182

Net income . . . . . . . . . . . . . . ............ 115,943 115,943

Change in fair value of derivatives qualifying as cash flow

hedges, net of tax of $5,023 . . . . . . . ......... 7,621 7,621

Translation adjustment changes . .............. 95,023 95,023

Unrealized holding losses on securities, net of tax of $4 . . . (30) (30)

Unrealized loss on Euro-denominated debt, net of tax of

$4,648 . . . . . . . . . . . . . . . . . .......... (7,066) (7,066)

Minimum pension liability adjustment, net of tax of $9 . . . . 14 14

Total Comprehensive Income . . . . . . ........... 211,505

Sale of common stock in initial public offering ........ 88,235,000 882 1,259,384 1,260,266

Cash dividends ($4.32 and $1.12 per common share) . . . . (1,174,456) (85,062) (1,259,518)

Stock-based employee compensation . . .......... 25,452 25,452

Sale of stock under employee equity offering ........ 2,883,692 29 24,208 24,237

Adjustment to initially apply FASB Statement No. 158, net of

tax of $4,873 (revised) . . . . . . . . . .......... 6,438 6,438

December 31, 2006 . . . . . . . . . . . . . . . ........ 320,618,692 3,206 — 2,427,293 9,535 94,528 2,534,562

Net income . . . . . . . . . . . . . . ............ 264,559 264,559

Change in fair value of derivatives qualifying as cash flow

hedges, net of tax of $31,294 . .............. (49,142) (49,142)

Translation adjustment changes . .............. 126,279 126,279

Unrealized holding losses on securities, net of tax of $7 . . . (51) (51)

Unrealized loss on Euro-denominated debt, net of tax of

$13,611 . . . . . . . . . . . . . . . . . .......... (20,729) (20,729)

Defined benefit pension plans:

Prior service cost from plan curtailment . . . . ...... 20 20

Amortization or settlement recognition of net loss . . . . . 4,048 4,048

Net gain arising during the period . . . . ......... 21,914 21,914

Income tax related to defined pension plans ........ (6,360) (6,360)

Defined benefit pension plans, net . . . . . ......... 19,622 19,622

Total Comprehensive Income . . . . . . ........... 340,538

Stock-based employee compensation . . .......... 32,939 32,939

Exercise of stock options . . . . . . . . . .......... 1,227,950 13 5,586 5,599

Cumulative effect of the adoption of FIN 48 ......... (3,644) (3,644)

Common shares issued to Directors . . . . ......... 15,441 328 328

Phantom shares issued to Directors . . . . ......... 192 192

Proceeds from disgorgement of stockholder short-swing

profits, net of tax of $1,880 . . . . . . ........... 2,875 2,875

December 31, 2007 . . . . . . . . . . . . . . . ........ 321,862,083 $3,219 $ — $ 2,469,213 $ 270,450 $ 170,507 $ 2,913,389

The accompanying notes are an integral part of these financial statements.

109