Hertz 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

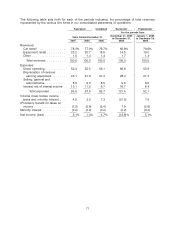

The following discussion and analysis of our results of operations and financial condition includes a

discussion of periods prior to the consummation of the Transactions. Accordingly, the discussion and

analysis of historical periods prior to the year ended December 31, 2006 does not reflect the significant

impact that the Transactions had on us, including significantly increased leverage and liquidity

requirements. The statements in this discussion and analysis regarding industry outlook, our expectations

regarding the performance of our business and the other non-historical statements are forward-looking

statements. These forward-looking statements are subject to numerous risks and uncertainties, including,

but not limited to, the risks and uncertainties described in ‘‘Item 1A—Risk Factors.’’ The following

discussion and analysis provides information that we believe to be relevant to an understanding of our

consolidated financial condition and results of operations. Our actual results may differ materially from

those contained in or implied by any forward-looking statements. You should read the following

discussion together with the sections entitled ‘‘Cautionary Note Regarding Forward-Looking

Statements,’’ ‘‘Item 1A—Risk Factors,’’ ‘‘Item 6—Selected Financial Data’’ and our consolidated financial

statements and related notes included in this Annual Report under the caption ‘‘Item 8—Financial

Statements and Supplementary Data.’’

Overview

We are engaged principally in the business of renting cars and renting equipment.

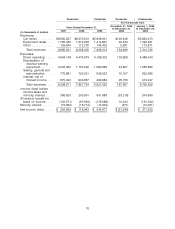

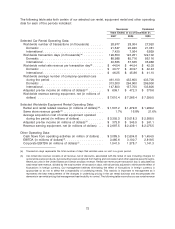

Our revenues primarily are derived from rental and related charges and consist of:

• Car rental revenues (revenues from all company-operated car rental operations, including

charges to customers for the reimbursement of costs incurred relating to airport concession fees

and vehicle license fees, the fueling of vehicles and the sale of loss or collision damage waivers,

liability insurance coverage and other products);

• Equipment rental revenues (revenues from all company-operated equipment rental operations,

including amounts charged to customers for the fueling and delivery of equipment and sale of

loss damage waivers); and

• Other revenues (fees and certain cost reimbursements from our licensees and revenues from our

car leasing operations and our third-party claim management services).

Our equipment rental business also derives revenues from the sale of new equipment and consumables.

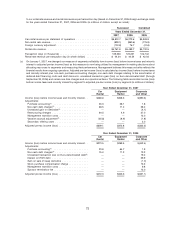

Our expenses primarily consist of:

• Direct operating expenses (primarily wages and related benefits; commissions and concession

fees paid to airport authorities, travel agents and others; facility, self-insurance and reservation

costs; the cost of new equipment and consumables purchased for resale; and other costs relating

to the operation and rental of revenue earning equipment, such as damage, maintenance and

fuel costs);

• Depreciation expense relating to revenue earning equipment (including net gains or losses on the

disposal of such equipment). Revenue earning equipment includes cars and rental equipment;

• Selling, general and administrative expenses (including advertising); and

• Interest expense, net of interest income.

63