Hertz 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Europe offsetting lower price activity in the U.S. During the years ended December 31, 2007 and 2006,

HERC added six and eight U.S. locations, respectively, one and two new Canadian location(s),

respectively, and seven and seven locations in Europe, respectively. HERC expects to add over 30

additional locations worldwide in 2008. In connection with its U.S. expansion, we expect HERC will incur

non-fleet start-up costs of approximately $0.7 million per location and additional fleet acquisition costs,

including costs to transport equipment from one branch to another, over an initial twelve-month period of

approximately $2 to $4 million per location. In its European expansion, we expect HERC will incur lower

start-up costs per location as compared with the United States.

Property damage and business interruption from the 2005 hurricanes in Florida and other Gulf Coast

states did not have a material effect on our results of operations for the year ended December 31, 2005.

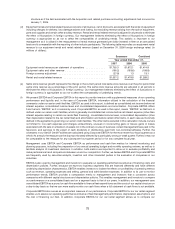

Critical Accounting Policies and Estimates

Our discussion and analysis of financial condition and results of operations are based upon our

consolidated financial statements, which have been prepared in accordance with accounting principles

generally accepted in the United States of America, or ‘‘GAAP.’’ The preparation of these financial

statements requires management to make estimates and judgments that affect the reported amounts in

our financial statements and accompanying notes.

We believe the following critical accounting policies affect the more significant judgments and estimates

used in the preparation of our financial statements and changes in these judgments and estimates may

impact our future results of operations and financial condition. For additional discussion of our

accounting policies, see Note 1 to the Notes to our consolidated financial statements included in this

Annual Report under the caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

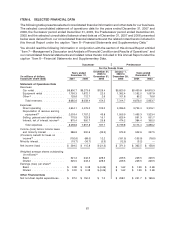

Revenue Earning Equipment

Our principal assets are revenue earning equipment, which represented approximately 54% of our total

assets as of December 31, 2007. Revenue earning equipment consists of vehicles utilized in our car

rental operations and equipment utilized in our equipment rental operations. For the year ended

December 31, 2007, 50% of the vehicles purchased for our U.S. and international car rental fleets were

subject to repurchase by automobile manufacturers under contractual repurchase and guaranteed

depreciation programs, subject to certain manufacturers’ car condition and mileage requirements, at a

specific price during a specified time period. These programs limit our residual risk with respect to

vehicles purchased under these programs. For all other vehicles, as well as equipment acquired by our

equipment rental business, we use historical experience and monitor market conditions to set

depreciation rates. When revenue earning equipment is acquired, we estimate the period that we will

hold the asset. Depreciation is recorded on a straight-line basis over the estimated holding period, with

the objective of minimizing gain or loss on the disposition of the revenue earning equipment.

Depreciation rates are reviewed on an ongoing basis based on management’s routine review of present

and estimated future market conditions and their effect on residual values at the time of disposal. Upon

disposal of the revenue earning equipment, depreciation expense is adjusted for the difference between

the net proceeds received and the remaining net book value. As market conditions change, we adjust

our depreciation rates prospectively, over the remaining holding period, to reflect these changes in

market conditions. See Note 6 to the Notes to our consolidated financial statements included in this

Annual Report under the caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

Public Liability and Property Damage

The obligation for public liability and property damage on self-insured U.S. and international vehicles

and equipment represents an estimate for both reported accident claims not yet paid, and claims

incurred but not yet reported. The related liabilities are recorded on a non-discounted basis. Reserve

66