Hertz 2007 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

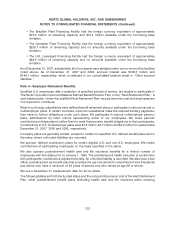

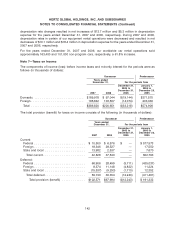

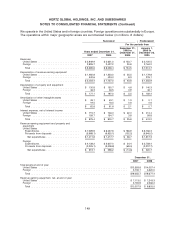

The principal items of the U.S. and foreign net deferred tax liability at December 31, 2007 and 2006 are as

follows (in thousands of dollars):

2007 2006

Deferred Tax Assets:

Employee benefit plans ................................. $ 155,478 $ 130,966

Net operating loss carryforwards ........................... 490,843 450,655

Foreign tax credit carryforwards ........................... 21,177 14,604

Federal and state tax credit carryforwards .................... 5,379 4,683

Accrued and prepaid expenses ............................ 161,718 89,809

Total Deferred Tax Assets ................................ 834,595 690,717

Less: Valuation Reserves ................................ (69,879) (70,102)

Total Net Deferred Tax Assets ............................. 764,716 620,615

Deferred Tax Liabilities:

Depreciation on tangible assets ............................ (1,414,946) (1,207,796)

Intangible assets ...................................... (1,146,869) (1,213,892)

Total Deferred Tax Liabilities .............................. (2,561,815) (2,421,688)

Net Deferred Tax Liability ............................... $(1,797,099) $(1,801,073)

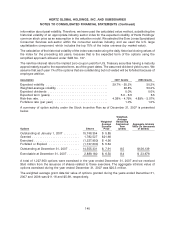

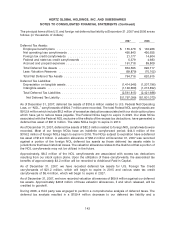

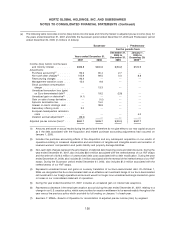

As of December 31, 2007, deferred tax assets of $316.6 million related to U.S. Federal Net Operating

Loss, or ‘‘NOL,’’ carryforwards of $904.7 million were recorded. The total Federal NOL carryforwards are

$912.9 million which include $8.2 million of excess tax deductions associated with our stock option plans

which have yet to reduce taxes payable. The Federal NOLs begin to expire in 2025. Our state NOLs

associated with the Federal NOL exclusive of the effects of the excess tax deductions, have generated a

deferred tax asset of $91.9 million. The state NOLs begin to expire in 2010.

As of December 31, 2007, deferred tax assets of $82.3 million related to foreign NOL carryforwards were

recorded. Most of our foreign NOLs have an indefinite carryforward period; $44.0 million of the

$316.2 million of foreign NOLs begin to expire in 2016. The NOLs subject to expiration have a deferred

tax asset of $12.6 million. A valuation allowance of $56.2 million at December 31, 2007 was recorded

against a portion of the foreign NOL deferred tax assets as those deferred tax assets relate to

jurisdictions that have historical losses. The valuation allowance relates to the likelihood that a portion of

the NOL carryforwards may not be utilized in the future.

Approximately, $8.2 million of the NOL carryforwards are associated with excess tax deductions

resulting from our stock option plans. Upon the utilization of these carryforwards, the associated tax

benefits of approximately $3.2 million will be recorded to Additional Paid-in Capital.

As of December 31, 2007, we have recorded deferred tax assets for U.S. Foreign Tax Credit

carryforwards of $21.2 million, which will begin to expire in 2015 and various state tax credit

carryforwards of $5.4 million, which will begin to expire in 2027.

As of December 31, 2007, we have recorded valuation allowances of $69.9 million against our deferred

tax assets. Approximately $49.8 million of these valuation allowances, if and when released, will be

credited to goodwill.

During 2006, a third party was engaged to perform a comprehensive analysis of deferred taxes. The

deferred tax analysis resulted in a $159.4 million decrease to our deferred tax liability and a

143