Hertz 2007 Annual Report Download - page 85

Download and view the complete annual report

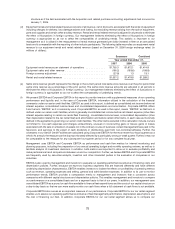

Please find page 85 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.operations, as well as financial and reservations-related positions in our U.S. service center in Oklahoma

City, Oklahoma. These reductions are expected to result in approximately $24.0 million of annualized

savings.

During 2007, we began to implement cost reducing initiatives in our European operations, and we

expect to continue implementation of these measures in 2008. These measures are expected to result in

additional annualized savings of approximately $50.0 million, a portion of which has already been

realized in 2007. For the year ended December 31, 2007, our consolidated statement of operations

includes restructuring charges relating to the initiatives discussed above of $96.4 million. During the

fourth quarter of 2007, we finalized or substantially completed contract terms with industry leading

service providers to outsource select functions relating to real estate facilities management and

construction, procurement and information technology. Substantially all of the selected functions in

these areas will be transitioned to the third-party service providers which will result in a decrease in

headcount by the end of the third quarter of 2008. We expect to incur between $30 million to $40 million

of restructuring costs in the first half of 2008 related to these initiatives. We plan to announce, as plans

are finalized, other efficiency initiatives during 2008. We currently anticipate incurring future charges to

earnings in connection with those initiatives; however, we have not yet developed detailed estimates of

these expenses. See Note 12 to the Notes to our consolidated financial statements included in this

Annual Report under the caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

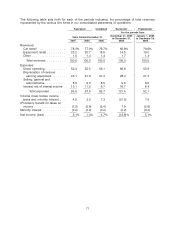

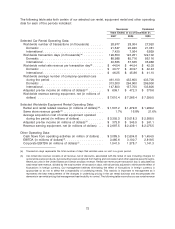

For the year ended December 31, 2007, based on publicly available information, we believe some U.S.

car rental brands experienced transaction day growth and rental rate revenue per transaction day, or

‘‘RPD,’’ increases compared to comparable prior periods. For the year ended December 31, 2007, we

experienced a low to mid single digit volume increase versus the prior period in the United States, while

RPD was down less than one percentage point. During the year ended December 31, 2007, we

experienced mid to high single digit volume growth in our European operations and our car rental RPD

was above the level of our RPD during the year ended December 31, 2006.

In the three years ended December 31, 2007, we increased the number of our off-airport rental locations

in the United States by approximately 27% to approximately 1,580 locations. Revenues from our U.S.

off-airport operations grew during the same period, representing $962.0 million, $890.1 million and

$845.8 million of our total car rental revenues in the years ended December 31, 2007, 2006 and 2005,

respectively. In 2008 and subsequent years, our strategy will include selected openings of new

off-airport locations, the disciplined evaluation of existing locations and the pursuit of same-store sales

growth. Our strategy includes increasing penetration in the off-airport market and growing the online

leisure market, particularly in the longer length weekly sector, which is characterized by lower vehicle

costs and lower transaction costs at a lower RPD. Increasing our penetration in these sectors is

consistent with our long term strategy to generate profitable growth. When we open a new off-airport

location, we incur a number of costs, including those relating to site selection, lease negotiation,

recruitment of employees, selection and development of managers, initial sales activities and integration

of our systems with those of the companies who will reimburse the location’s replacement renters for

their rentals. A new off-airport location, once opened, takes time to generate its full potential revenues,

and as a result revenues at new locations do not initially cover their start-up costs and often do not, for

some time, cover the costs of their ongoing operation.

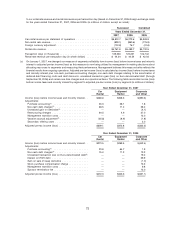

From 2001 to 2003, the equipment rental industry experienced downward pricing trends, measured by

the rental rates charged by rental companies. For the years ended December 31, 2004, 2005 and 2006,

we believe industry pricing, measured in the same way, improved in the United States and Canada and

only started to improve towards the end of 2005 in France and Spain. For the year ended December 31,

2007, based on publicly available information, we believe the U.S. equipment rental industry

experienced downward pricing, measured by the rental rates charged by rental companies. HERC

experienced higher equipment rental pricing and volumes worldwide for the years ended December 31,

2007, 2006 and 2005, with pricing increases in 2007 attributable to higher price activity in Canada and

65