Hertz 2007 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

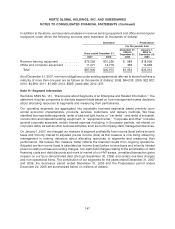

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

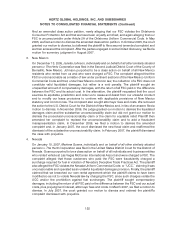

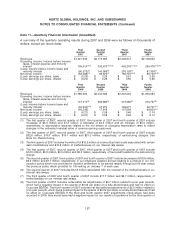

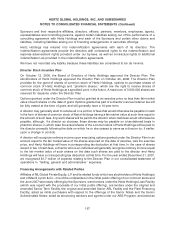

Note 11—Quarterly Financial Information (Unaudited)

A summary of the quarterly operating results during 2007 and 2006 were as follows (in thousands of

dollars, except per share data):

First Second Third Fourth

Quarter Quarter Quarter Quarter

2007 2007 2007 2007

Revenues .......................$1,921,532 $2,175,664 $2,449,612 $2,138,823

Operating income: income before income

taxes, interest expense and minority

interest ....................... 139,014(1)(2) 332,473(1)(2)(5) 495,276(1)(2)(5) 295,479(1)(2)(5)

(Loss) income before income taxes and

minority interest ................. (90,573)(3) 140,959(6) 255,126(7) 81,308(7)

Net (loss) income .................. (62,566)(4) 83,675(4) 162,707(4)(8) 80,743(4)(8)

(Loss) earnings per share, basic ........$ (0.20) $ 0.26 $ 0.51 $ 0.25

(Loss) earnings per share, diluted .......$ (0.20) $ 0.26 $ 0.50 $ 0.25

First Second Third Fourth

Quarter Quarter Quarter Quarter

2006 2006 2006 2006

Revenues .......................$1,786,594 $2,040,633 $2,240,594 $1,990,584

Operating income: income before income

taxes, interest expense and minority

interest ....................... 147,013(9) 269,883(9) 413,685(9) 270,727(9)

(Loss) income before income taxes and

minority interest ................. (63,300)(10) 57,273 163,971 42,707(11)

Net (loss) income .................. (49,236) 17,818 107,538 39,823(12)

(Loss) earnings per share, basic ........$ (0.21) $ 0.08 $ 0.46 $ 0.14

(Loss) earnings per share, diluted .......$ (0.21) $ 0.08 $ 0.46 $ 0.14

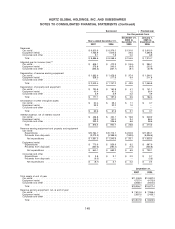

(1) The first quarter of 2007, second quarter of 2007, third quarter of 2007 and fourth quarter of 2007 include

increases of $3.3 million and $1.3 million, a decrease of $4.5 million and an increase of $0.5 million,

respectively, in depreciation expense related to the net effects of changing depreciation rates to reflect

changes in the estimated residual value of revenue earning equipment.

(2) The first quarter of 2007, second quarter of 2007, third quarter of 2007 and fourth quarter of 2007 include

$32.6 million, $16.7 million, $16.1 million and $31.0 million, respectively, of restructuring charges. See

Note 12—Restructuring.

(3) The first quarter of 2007 includes the write-off of $16.2 million of unamortized debt costs associated with certain

debt modifications and $12.8 million of ineffectiveness on our interest rate swaps.

(4) The first quarter of 2007, second quarter of 2007, third quarter of 2007 and fourth quarter of 2007 include

$12.5 million, $3.3 million, $4.5 million and $5.3 million, respectively, of tax benefit related to the restructuring

charge.

(5) The second quarter of 2007, third quarter of 2007 and fourth quarter of 2007 include decreases of $19.6 million,

$9.2 million and $7.7 million, respectively, in our employee vacation accrual relating to a change in our U.S.

vacation policy which now provides for vacation entitlement to be earned ratably throughout the year versus

the previous policy which provided for full vesting on January 1 of each year.

(6) The second quarter of 2007 includes $12.8 million associated with the reversal of the ineffectiveness of our

interest rate swaps.

(7) The third quarter of 2007 and fourth quarter of 2007 include $17.7 million and $2.7 million, respectively, of

ineffectiveness on our interest rate swaps.

(8) The third quarter of 2007 includes unfavorable tax adjustments of $5.7 million related to prior year periods,

which had a negative impact in the quarter of $0.02 per share on a fully diluted basis and had no effect on

Corporate EBITDA. The fourth quarter of 2007 includes net favorable tax adjustments of $5.0 million related to

prior year periods, which had a positive impact in the quarter of $0.02 per share on a fully diluted basis and had

no effect on Corporate EBITDA. If the third and fourth quarter 2007 adjustments noted above had been

recorded in 2006, they would have had a negative impact on our results of operations for the third quarter of

157