Hertz 2007 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

U.K. Leveraged Financing. On December 21, 2007, our subsidiary in the United Kingdom, or the

‘‘U.K.,’’ Hertz (U.K.) Limited, entered into an agreement for a sale and lease back facility with a financial

institution in the U.K., under which we may sell and leaseback fleet up to the value of £135.0 million (or

$271.2 million). The amount available under this facility increases over the term of the facility. The facility

is scheduled to mature in December 2013. This facility refinanced the U.K. portion of the International

Fleet Debt facilities. This facility is guaranteed by HIL and pricing is based on current LIBOR. This facility

contains covenants typical for this type of facility including restrictions on engaging in mergers and

change of business, and includes requirements to meet on a quarterly basis certain ratios measuring

utilization, interest coverage and net worth. As of December 31, 2007, the foreign currency equivalent of

$222.7 million in borrowings were outstanding under this facility.

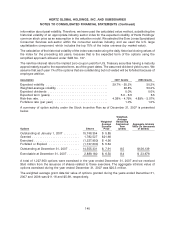

Pre-Acquisition Debt

As of December 31, 2007, we had approximately $509.4 million (net of a $5.1 million discount)

outstanding in pre-Acquisition promissory notes issued under three separate indentures at an average

interest rate of 7.1%. These pre-Acquisition promissory notes have maturities ranging from 2008 to 2028.

As of December 31, 2006, we had approximately e7.6 million (or $10.0 million) outstanding in

pre-Acquisition Euro Medium Term Notes, in connection with which we entered into an interest rate swap

agreement on December 21, 2005, effective January 16, 2006 and maturing on July 16, 2007. The

purpose of this interest rate swap was to lock in the interest cash outflows at a fixed rate of 4.1% on the

variable rate Euro Medium Term Notes. On June 30, 2007, the remaining notes outstanding and related

interest rate swap agreements pursuant to the Euro Medium Term Note Program were repaid in full and

expired, respectively.

We also had outstanding as of December 31, 2007 approximately $303.6 million in borrowings, net of a

$3.9 million discount, consisting of pre-Acquisition ABS Notes with an average interest rate of 3.1%.

These pre-Acquisition ABS Notes have maturities ranging from 2008 to 2009. See ‘‘U.S. Fleet Debt’’ for a

discussion of the collateralization of the pre-Acquisition ABS Notes.

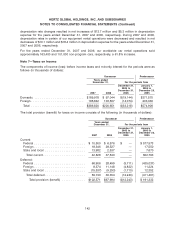

Credit Facilities

As of December 31, 2007, the following credit facilities were available for the use of Hertz and its

subsidiaries:

• The Senior Term Facility had approximately $7.3 million available under the letter of credit facility.

• The Senior ABL Facility had the foreign currency equivalent of approximately $1,570.6 million of

remaining capacity, all of which was available under the borrowing base limitation and

$178.6 million of which was available under the letter of credit facility sublimit.

• The U.S. Fleet Debt had approximately $1,500.0 million of remaining capacity and $17.8 million

available under the borrowing base limitation. No additional amounts were available under the

letter of credit facility.

• The International Fleet Debt facilities had the foreign currency equivalent of approximately

$885.6 million of remaining capacity and $223.3 million available under the borrowing base

limitation.

• The Fleet Financing Facility had approximately $103.0 million of remaining capacity and

$4.8 million available under the borrowing base limitation.

132