Hertz 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

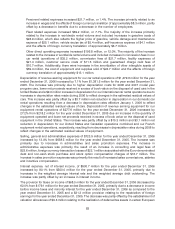

countries and the establishment of certain federal and state contingencies for the year ended

December 31, 2006 and the reversal of a valuation allowance on foreign tax credit carryforwards of

$35.0 million and favorable foreign tax adjustments of $5.3 million for the year ended December 31,

2005. The effective tax rate for the year ended December 31, 2006 was 33.9% as compared to 33.1% for

the year ended December 31, 2005. See Note 7 to the Notes to our consolidated financial statements

included in this Annual Report under the caption ‘‘Item 8—Financial Statements and Supplementary

Data.’’

Minority interest of $16.7 million for the year ended December 31, 2006 increased $4.1 million from

$12.6 million for the year ended December 31, 2005. The increase was due to an increase in our

majority-owned subsidiary Navigation Solutions, L.L.C.’s net income in the year ended December 31,

2006.

Net Income

We had net income of $115.9 million for the year ended December 31, 2006, representing a decrease of

$234.1 million, or 66.9%, from $350.0 million for the year ended December 31, 2005. The decrease in net

income was primarily due to the 80.1% increase in interest expense over the year ended December 31,

2005, as well as the net effect of other contributing factors noted above. The impact of changes in

exchange rates on net income was mitigated by the fact that not only foreign revenues but also most

foreign expenses were incurred in local currencies.

Effects of Acquisition

Increased interest expense resulting from our higher debt levels and increased depreciation and

amortization expense resulting from the revaluation of our tangible assets and the recognition of certain

identified intangible assets, all in connection with the Acquisition, had a significant adverse impact on full

year 2006 income before income taxes and minority interest.

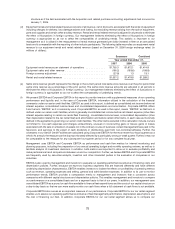

The following table summarizes the purchase accounting effects of the Acquisition on our results of

operations for the year ended December 31, 2006 (in millions of dollars):

Depreciation and amortization of tangible and intangible assets:

Other intangible assets ................................................. $61.2

Revenue earning equipment ............................................. 13.8

Property and equipment ................................................ 10.0

Accretion of revalued liabilities:

Discount on debt ..................................................... 8.8

Workers’ compensation and public liability and property damage .................. 5.4

$99.2

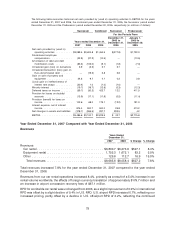

Liquidity and Capital Resources

As of December 31, 2007, we had cash and equivalents of $730.2 million, an increase of $55.7 million

from December 31, 2006. As of December 31, 2007, we had $661.0 million of restricted cash to be used

for the purchase of revenue earning vehicles and other specified uses under our Fleet Debt facilities, our

like-kind exchange programs and to satisfy certain of our self-insurance regulatory reserve

requirements.

Our domestic and foreign operations are funded by cash provided by operating activities and by

extensive financing arrangements maintained by us in the United States, Europe, Puerto Rico, Australia,

New Zealand, Canada and Brazil. Net cash provided by operating activities during the year ended

December 31, 2007 was $3,089.5 million, an increase of $484.7 million from the year ended

December 31, 2006. This increase was primarily due to a year-over-year improvements in working

capital and net income.

84