Hertz 2007 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Foreign Currency Risk

We manage our foreign currency risk primarily by incurring, to the extent practicable, operating and

financing expenses in the local currency in the countries in which we operate, including making fleet and

equipment purchases and borrowing for working capital needs. Also, we have purchased foreign

exchange options to manage exposure to fluctuations in foreign exchange rates for selected marketing

programs. The effect of exchange rate changes on these financial instruments would not materially

affect our consolidated financial position, results of operations or cash flows. Our risks with respect to

foreign exchange option contracts are limited to the premium paid for the right to exercise the option and

the future performance of the option’s counterparty. Premiums paid for options outstanding as of

December 31, 2007 were approximately $0.3 million and we limit counterparties to financial institutions

that have strong credit ratings. At December 31, 2007, the total notional amount of these foreign

exchange options was $8.0 million, maturing at various dates in 2008 and 2009, and the fair value of all

outstanding foreign exchange options, was approximately $0.1 million. The fair value of the foreign

currency options were estimated using market prices provided by financial institutions. Gains and losses

resulting from changes in the fair value of these options are included in our results of operations. The

total notional amount included options to sell Euro, Canadian dollars and yen in the amounts of

$4.6 million, $2.4 million and $1.0 million, respectively.

We also manage exposure to fluctuations in currency risk on intercompany loans we make to certain of

our subsidiaries by entering into foreign currency forward contracts at the time of the loans. The forward

rate is reflected in the intercompany loan rate to the subsidiaries, and as a result, the forward contracts

have no material impact on our results of operations. At December 31, 2007, the total notional amount of

these forwards was $230.2 million, maturing within one to four months. The total notional amount

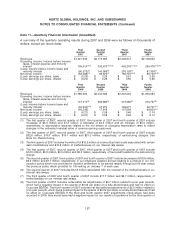

includes forwards translated into U.S. dollar equivalent amounts as follows (in millions of dollars):

Buy

Canadian New Zealand Australian

Sell Dollar Dollar Dollar

Euro ............................................ $205.1 — —

Australian Dollar ................................... — $13.8 —

U.S. Dollar ....................................... — — $11.3

In connection with the Transactions, we issued e225 million of Senior Euro Notes. Prior to October 1,

2006, our Senior Euro Notes were not designated as a net investment hedge of our Euro-denominated

net investments in our foreign operations. For the nine months ended September 30, 2006, we incurred

unrealized exchange transaction losses of $19.2 million, resulting from the translation of these

Euro-denominated notes into the U.S. dollar, which are recorded in our consolidated statement of

operations in ‘‘Selling, general and administrative’’ expenses. On October 1, 2006, we designated our

Senior Euro Notes as an effective net investment hedge of our Euro-denominated net investment in our

foreign operations. As a result of this net investment hedge designation, as of December 31, 2007,

$27.8 million of losses, which are net of tax of $18.3 million, attributable to the translation of our Senior

Euro Notes into the U.S. dollar, are recorded in our consolidated balance sheet in ‘‘Accumulated other

comprehensive income.’’

162