Hertz 2007 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

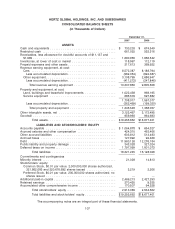

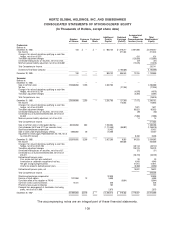

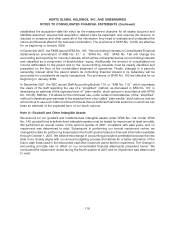

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

(In Thousands of Dollars)

Successor Predecessor

For the periods from

December 21, January 1,

2005 to 2005 to

Years ended December 31, December 31, December 20,

2007 2006 2005 2005

Cash flows from investing activities:

Net change in restricted cash .................... $ (105,856) $ (260,212) $ (273,640) $ (12,660)

Purchase of predecessor company stock ............. — — (4,379,374) —

Proceeds from sales of short-term investments, net ....... — — — 556,997

Revenue earning equipment expenditures ............ (11,342,095) (11,420,898) (234,757) (12,186,205)

Proceeds from disposal of revenue earning equipment ..... 9,214,266 9,555,025 199,711 10,106,260

Property and equipment expenditures ............... (196,001) (223,943) (8,503) (334,543)

Proceeds from disposal of property and equipment ....... 98,957 73,887 1,528 76,379

Licensee acquisitions ......................... (12,514) — — —

Other investing activities ....................... (362) (2,016) — 2

Net cash used in investing activities ............. (2,343,605) (2,278,157) (4,695,035) (1,793,770)

Cash flows from financing activities:

Issuance of an intercompany note ................. — — — 1,185,000

Proceeds from issuance of long-term debt ............ 9,903 1,309,437 8,643,894 27,162

Repayment of long-term debt .................... (996,203) (1,247,425) (5,118,559) (619,402)

Short-term borrowings:

Proceeds ............................... 695,000 747,469 10,333 3,208,085

Repayments ............................. (695,000) (901,123) (1,357,614) (2,263,346)

Ninety-day term or less, net .................... 295,229 (465,595) 364,009 270,715

Dividends paid ............................. — (1,259,518) — (1,185,000)

Proceeds from the sale of stock .................. — 1,284,503 2,295,000 —

Distributions to minority interest ................... (13,475) (10,830) — (8,614)

Exercise of stock options ....................... 5,599 — — —

Proceeds from disgorgement of stockholder short-swing

profits ................................. 4,755 — — —

Payment of financing costs ..................... (39,895) (40,783) (192,419) —

Net cash (used in) provided by financing activities ..... (734,087) (583,865) 4,644,644 614,600

Effect of foreign exchange rate changes on cash and

equivalents ............................... 43,858 87,841 (1,894) (57,120)

Net increase (decrease) in cash and equivalents during the

period .................................. 55,654 (169,359) (330,088) 496,031

Cash and equivalents at beginning of period ............ 674,549 843,908 1,173,996 677,965

Cash and equivalents at end of period ................ $ 730,203 $ 674,549 $ 843,908 $ 1,173,996

Supplemental disclosures of cash flow information:

Cash paid (received) during the period for:

Interest (net of amounts capitalized) ................ $ 814,059 $ 681,480 $ 124,005 $ 416,436

Income taxes .............................. 28,293 33,645 (379) 29,883

Non-cash transactions excluded from cash flow presentation:

Revaluation of net assets to fair market value, net of tax .... $ — $ 75,459 $ 2,145,563 $ —

Non-cash settlement of outstanding balances with Ford .... — — 112,490 —

The accompanying notes are an integral part of these financial statements.

111