Hertz 2007 Annual Report Download - page 137

Download and view the complete annual report

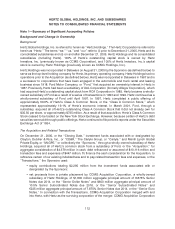

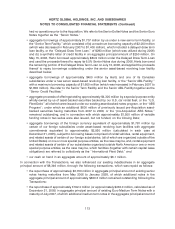

Please find page 137 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

portion of changes in fair value of derivatives designated as cash flow hedging instruments is recorded

as a component of other comprehensive income. The ineffective portion is recognized currently in

earnings within the same line item as the hedged item, based upon the nature of the hedged item. For

derivative instruments that are not part of a qualified hedging relationship, the changes in their fair value

are recognized currently in earnings. See Note 13—Financial Instruments.

Income Taxes

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to

differences between the financial statement carrying amounts of existing assets and liabilities and their

respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected

to apply to taxable income in the years in which those temporary differences are expected to be

recovered or settled. The effect of a change in tax rates is recognized in income in the period that

includes the enactment date. Valuation allowances are recorded to reduce deferred tax assets when it is

more likely than not that a tax benefit will not be realized. Provisions are not made for income taxes on

undistributed earnings of foreign subsidiaries that are intended to be indefinitely reinvested outside the

United States or are expected to be remitted free of taxes.

Sales tax amounts collected from customers have been recorded on a net basis.

Prior to the Acquisition, Hertz and its domestic subsidiaries filed a consolidated federal income tax return

with Ford. Pursuant to a tax sharing agreement, or the ‘‘Agreement,’’ with Ford, current and deferred

taxes were reported and paid to Ford, as if Hertz had filed its own consolidated tax returns with its

domestic subsidiaries. The Agreement provided that Hertz was reimbursed for foreign tax credits in

accordance with the utilization of those credits by the Ford consolidated tax group.

On December 21, 2005, in connection with the Acquisition, the Agreement with Ford was terminated.

Upon termination, all tax payables and receivables with Ford were cancelled and neither Hertz nor Ford

has any future rights or obligations under the Agreement. Hertz may be exposed to tax liabilities

attributable to periods it was a consolidated subsidiary of Ford. While Ford has agreed to indemnify

Hertz for certain tax liabilities pursuant to the arrangements relating to our separation from Ford, we

cannot offer assurance that payments in respect of the indemnification agreement will be available.

See Note 7—Taxes on Income.

Advertising

Advertising and sales promotion costs are expensed as incurred.

Legal Fees

We accrue for legal fees and other directly related costs of third parties when it is probable that such fees

and costs will be incurred and the amounts can be reasonably estimated.

Impairment of Long-Lived Assets and Intangibles

We evaluate the carrying value of goodwill and indefinite-lived intangible assets for impairment at least

annually in accordance with SFAS No. 142 ‘‘Goodwill and Other Intangible Assets.’’ See Note 2—

Goodwill and Other Intangible Assets. Long-lived assets, other than goodwill and indefinite-lived

intangible assets, are reviewed for impairment in accordance with SFAS No. 144, ‘‘Accounting for the

Impairment or Disposal of Long-Lived Assets.’’ Under SFAS No. 144, these assets are tested for

impairment whenever events or changes in circumstances indicate that the carrying amounts of

117