Hertz 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234

|

|

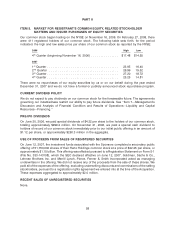

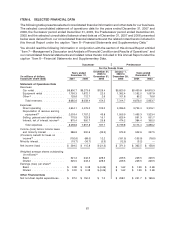

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock began trading on the NYSE on November 16, 2006. On February 27, 2008, there

were 411 registered holders of our common stock. The following table sets forth, for the period

indicated, the high and low sales price per share of our common stock as reported by the NYSE:

2006 High Low

4th Quarter (beginning November 16, 2006) ............... $17.48 $14.55

2007

1st Quarter ....................................... 23.95 16.40

2nd Quarter ...................................... 26.99 19.52

3rd Quarter ....................................... 27.20 18.72

4th Quarter ....................................... 25.25 14.81

There were no repurchases of our equity securities by us or on our behalf during the year ended

December 31, 2007 and we do not have a formal or publicly announced stock repurchase program.

CURRENT DIVIDEND POLICY

We do not expect to pay dividends on our common stock for the foreseeable future. The agreements

governing our indebtedness restrict our ability to pay future dividends. See ‘‘Item 7—Management’s

Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital

Resources—Financing.’’

PRE-IPO DIVIDENDS

On June 30, 2006, we paid special dividends of $4.32 per share to the holders of our common stock,

totaling approximately $999.2 million. On November 21, 2006, we paid a special cash dividend to

holders of record of our common stock immediately prior to our initial public offering in an amount of

$1.12 per share, or approximately $260.3 million in the aggregate.

USE OF PROCEEDS FROM SALES OF REGISTERED SECURITIES

On June 12, 2007, the investment funds associated with the Sponsors completed a secondary public

offering of 51,750,000 shares of their Hertz Holdings common stock at a price of $22.25 per share, or

approximately $1.15 billion. This offering was effected pursuant to a Registration Statement on Form S-1

(File No. 333-143108), which the SEC declared effective on June 12, 2007. Goldman, Sachs & Co.,

Lehman Brothers Inc. and Merrill Lynch, Pierce, Fenner & Smith Incorporated acted as managing

underwriters in the offering. We did not receive any of the proceeds from the sale of these shares. We

paid all of the expenses of the offering, excluding underwriting discounts and commissions of the selling

stockholders, pursuant to a registration rights agreement we entered into at the time of the Acquisition.

These expenses aggregated to approximately $2.0 million.

RECENT SALES OF UNREGISTERED SECURITIES

None.

58