Hertz 2007 Annual Report Download - page 227

Download and view the complete annual report

Please find page 227 of the 2007 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234

|

|

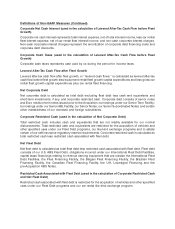

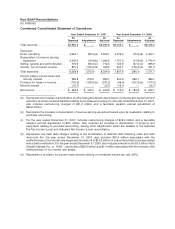

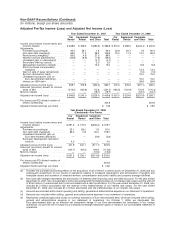

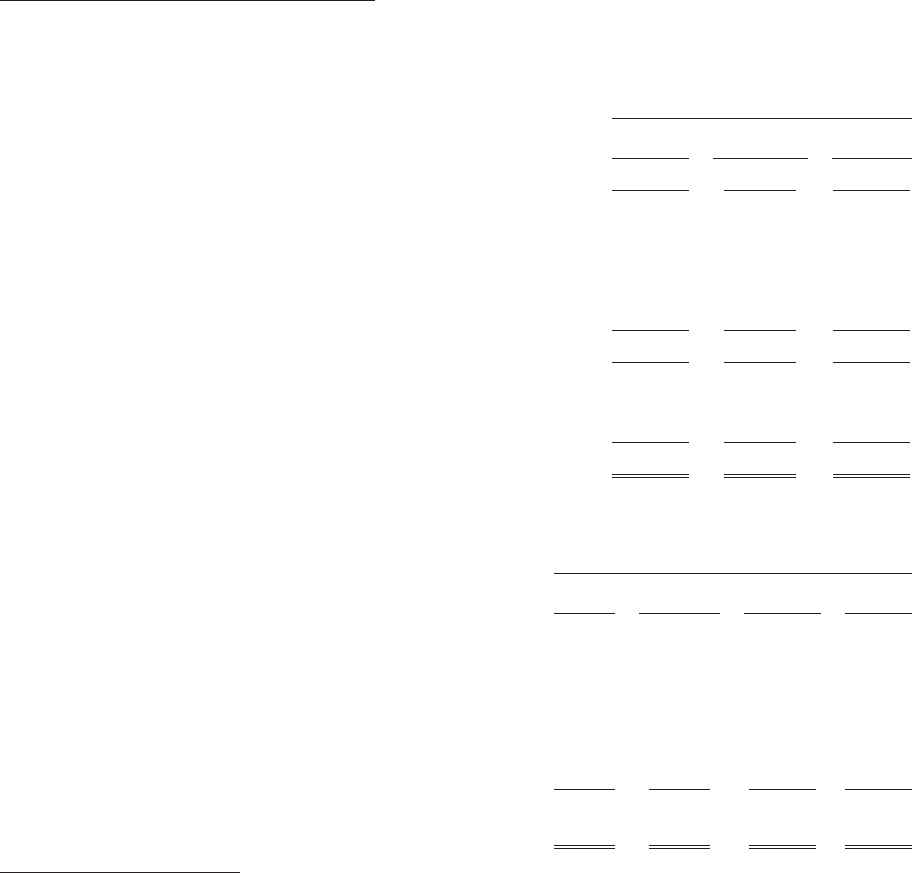

Non-GAAP Reconciliations (Continued)

(In millions)

Condensed Consolidated Statement of Operations

Year Ended December 31, 2005

(Combined)

Pro Forma

Historical Adjustments Pro Forma

Total revenues .................................... $7,469.2 $ — $7,469.2

Expenses:

Direct operating ................................... 4,189.3 74.5(a) 4,263.8

Depreciation of revenue earning equipment ............... 1,599.7 13.0(b) 1,612.7

Selling, general and administrative ...................... 638.5 0.9(c) 639.4

Interest, net of interest income ......................... 500.0 323.6(d) 823.6

Total expenses .................................... 6,927.5 412.0 7,339.5

Income (loss) before income taxes and minority interest ...... 541.7 (412.0) 129.7

(Provision) benefit for taxes on income ................... (179.1) 109.2(e) (69.9)

Minority interest ................................... (12.6) — (12.6)

Net income (loss) .................................. $ 350.0 $ (302.8) $ 47.2

Income (Loss) Before Income Taxes and Minority Interest by Segment

Year Ended December 31, 2005 (Combined)

Car Equipment Corporate

Rental Rental and Other Total

Historical income (loss) before income taxes and minority

interest ................................... $374.6 $239.1 $ (72.0) $ 541.7

Pro Forma Adjustments:

Direct operating (a) ........................... (26.6) (34.0) (13.9) (74.5)

Depreciation of revenue earning equipment (b) ....... 16.8 (29.8) — (13.0)

Selling, general and administrative (c) ............. (17.2) (0.1) 16.4 (0.9)

Interest, net of interest income (d) ................ (56.0) (1.9) (265.7) (323.6)

Pro forma income (loss) before income taxes and

minority interest ............................ $291.6 $173.3 $(335.2) $ 129.7

(a) Represents the increase in amortization of other intangible assets, depreciation of property and

equipment and accretion of certain revalued liabilities relating to purchase accounting.

(b) Represents the increase in depreciation of revenue earning equipment based upon its revaluation

relating to purchase accounting.

(c) Represents an increase in depreciation of property and equipment relating to purchase accounting.

(d) Represents the increase in interest expense giving effect to our new capital structure as if the debt

associated with the acquisition on December 21, 2005 had occurred on January 1, 2005.

(e) Represents a benefit for income taxes derived utilizing a normalized income tax rate of 35%. For the

year ended December 31, 2005, the impact of the reversal of the $35.0 million valuation allowance

on foreign tax credit carryforwards was excluded.